On 28 March 2017, the Turnbull Government released draft legislation which would implement wide-ranging reforms to Australia's corporate restructuring laws. The draft legislation focuses on reforms to the insolvent trading prohibition (Safe Harbour) and introducing a new stay on enforcing "ipso facto" clauses during certain restructuring procedures (Ipso Facto).

The release of the draft legislation is an important milestone in Australia's corporate insolvency law reform. With the draft legislation came confirmation of the proposed introduction of reforms on or around 1 January 2018. The landscape of Australian restructuring is now set to change.

Following from our consultation and "Let's optimise the opportunity for reform" submission in 2016 (Optimising the Reform), KWM again welcomed the opportunity to consult broadly across our practice to make our submission to Treasury on the draft legislation.

How did we get here?

The reforms which implemented the recommendations made in the Harmer Report were the last seismic shift in the Australian restructuring market.

Since the Harmer reforms in 1993, Australia's restructuring culture has increased its emphasis on restructuring through creditors' schemes and voluntary administration. In parallel, during the intervening 25 years or so, Australia's secondary debt market has deepened and there are more foreign-based creditors participating in Australian restructuring situations. The result has been an increased emphasis on trade-on restructurings where creditors compromise their positions as part of a consensual arrangement which preserves the enterprise as a going concern. .

Despite this, pressure on directors to consider their personal risk profile under Australia's draconian insolvent trading laws, and the distraction from the exercise of their general duties which comes with that, has continued. In effect, this has counterbalanced the deepening Australian restructuring culture and has pressured directors of distressed companies to prioritise management of their potential personal liability for insolvent trading, over the utilisation of less formal restructuring processes in an effort to save the company's business.

Where are we now?

With this background, the proposed reforms introduce a two-layered adjustment to the restructuring landscape.

First, the proposed Safe Harbour reform is a significant re-alignment of the insolvent trading prohibition. We endorse the approach that the Government has taken to the draft legislation, which we expect to incentivise directors to stay the course and fully explore restructuring efforts outside of the more formal procedures.

Second, in the post-Harmer era the Australian restructuring procedures which have clearly emerged as the primary ones are voluntary administration and schemes of arrangement. These procedures are well understood in the Australian market – there is a long line of Australian companies which have successfully restructured their debts using those procedures.

The proposed Ipso Facto stay would operate, properly in our view, exclusively during these two procedures when restricting counterparties' ipso facto rights. The intention of the Ipso Facto reform, clearly expressed in the legislation and explanatory materials, is to give companies additional breathing space to continue to trade whilst restructuring through voluntary administration and schemes of arrangement, and consequently to improve outcomes. This is an important second layer in the restructuring-related reforms which we endorse.

Our submission outlines our comments on the Safe Harbour and Ipso Facto reforms with reference to the proposed legislation and policy impacts. We endorse both reforms, but have made a number of suggestions aimed at the legislation better meeting the intention underpinning the reforms.

Here is an outline of the KWM "house view" on both reforms:

Safe Harbour

Directors should feel assured that the proposed safe harbour laws endeavour to provide them with a clear and flexible mandate to explore restructuring options.

Under the proposed Safe Harbour, directors will not be liable for insolvent trading while pursuing a course of action that is reasonably likely "… to lead to a better outcome for the company and the company's creditors".

The proposed reform re-sets the balance, in our view correctly, between directors' insolvent trading exposure, on the one hand, and their general (fiduciary) duties as directors on the other. Under the proposed Safe Harbour regime, upon the onset of financial distress, directors will have to ask themselves – "what are the options available to optimise the situation?"; rather than – "do we have to place the company into administration to avoid insolvent trading?" Critically, by providing directors with a clear and flexible mandate to explore such restructuring options, free from personal exposure, the proposed reform will re-establish the interests of the company (inclusive of all of its stakeholders) as the first priority for directors. Refer to our earlier submission: Optimising the Reform. For that reason, we consider that the proposed Safe Harbour will serve to facilitate innovation, enhance the corporate restructuring culture in Australia and reduce the stigma associated with corporate insolvency.

Whose interests should directors be seeking to optimise?

In our opinion it is only the outcome for the company which should be the focus of attention because that would align the Safe Harbour with the duties of directors generally. The interests of a company and its creditors may be quite different and, in our opinion, it is likely to cause confusion to require a qualifying "course of action" to contemplate improvement of the outcome for both the company and its creditors. In our submission it would not change the intention of the proposed reform to remove any confusion by deleting the specific reference to the company's creditors from the Safe Harbour. It has been clear for some time that, in discharging their duties owed to a company, directors must have regard to the interests of shareholders and creditors and, in circumstances of financial distress, the interests of creditors become more significant.

Increasing the scope of the Safe Harbour would provide better protection to directors

We have submitted that the scope of the Safe Harbour should be increased so as to provide better protection to directors by:

- extending the Safe Harbour to debts incurred while directors seek advice and undertake a strategic review to identify the restructuring or turnaround plan which has the best prospects of success; and

- clarifying that the Safe Harbour applies to all ordinary trading debts incurred while a restructuring or turnaround plan is pursued.

Read our full response to the proposed Safe Harbour reform.

Ipso Facto

The ipso facto reforms are aimed at allowing breathing space for companies while they restructure.

The proposed Ipso Facto stay applies to rights that are enforceable merely because the company has (i) appointed voluntary administrators or (ii) applied for approval of a scheme of arrangement to avoid an insolvent winding up.

We endorse the specific restructuring procedures that have been nominated by the Government for the benefit of the Ipso Facto stay – these procedures are collective procedures commonly used in the Australian market to restructure companies. Unlike the other insolvency procedures, the specific restructuring procedures that have been nominated by the Government are aimed at restructuring companies, are a collective procedure for the benefit of the company and are limited in duration.

The Government has chosen to proceed with the "broad brush" approach.

The Government has continued with what we describe as a "broad brush" approach to the Ipso Facto reforms. That is, the Ipso Facto stay will have a blanket effect on all contracts with specific exceptions, rather than being directed to specific types of contracts.

The categories of contracts currently identified to be carved out of the operation of the Ipso Facto stay include many types of financial contracts, as well as other specific examples we identified in our earlier submission: Optimising the Reform. In our submission, we identify a number of types of existing legislation, the operation of which will need to be expressly preserved after the introduction of the Ipso Facto stay to avoid what appear to be unintended consequences (eg the International Interests in Mobile Equipment (Cape Town Convention) Act 2013 (Cwlth)and the Payment Systems and Netting Act 1998 (Cwlth)).

Read our full response to the proposed Ipso Facto reform.

Potentially commencing on and from 1 January 2018, contracting parties should be aware of the implications of the "broad brush" approach.

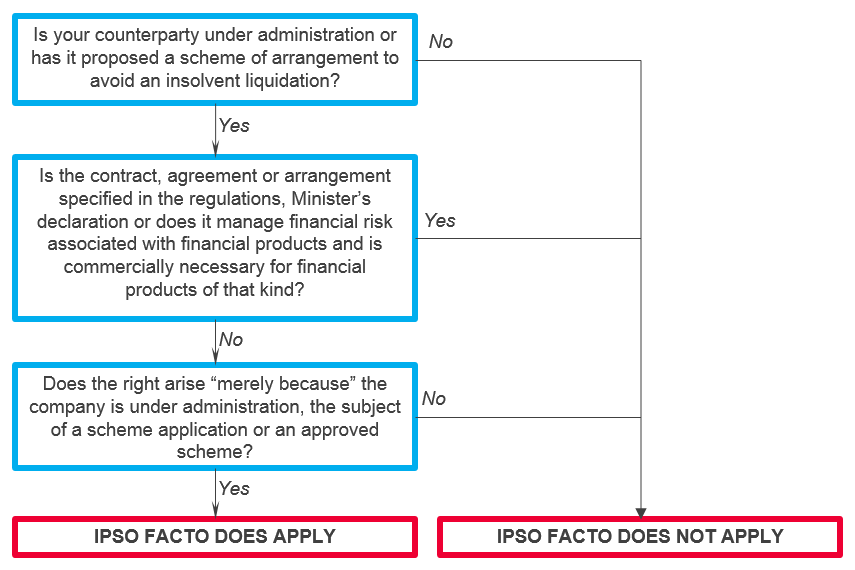

Contracting parties should consider whether they will be subject to the Ipso Facto stay once their counterparties enter administration or propose a scheme. Under the draft legislation, this is a three-stage analysis to evaluate whether the Ipso Facto stay applies to the exercise of rights under contracts, agreements or arrangements:

The effect on secured lending requires careful consideration in future drafts of the legislation: there are important implications for banks and other financiers in particular

Our submission notes the significant effect that the Ipso Facto stay would have on secured lending arrangements if enacted in its current form. It remains unclear whether the Ipso Facto reform is intended to have such a wide-ranging effect on the rights of secured lenders.

As we did in our earlier submission, Optimising the Reform, we have queried the effect that the reform could have on the pricing and availability of credit, unless protections are built in to clarify the impact on secured lending arrangements. In addition, the impact of the Ipso Facto reform on the remedy of receivership requires clarification.

Some questions the proposed Ipso Facto stay raises include the following:

- Will lenders be able to charge default interest, accelerate and enforce their security?

- If the counterparty continues performing, are there other risks that lenders need to protect against following voluntary administration or a scheme proposal?