This article was written by Stephan Cerni and Andy Wu.

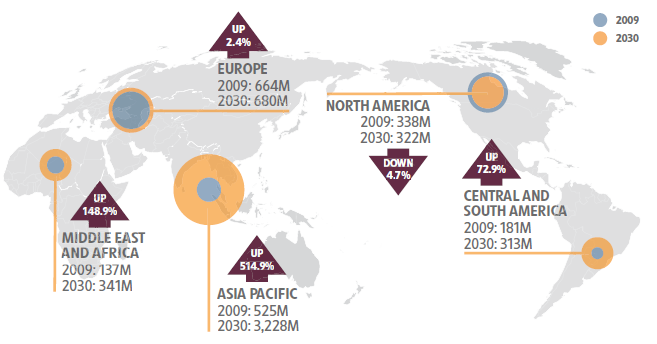

The world's population is projected to reach 8.5 billion by 2030 and, according to the OECD, China and India will represent roughly two thirds of the global middle class population. This exponential rate of growth is staggering when compared against the rest of the world (as illustrated in Figure 1 below).

The rising middle class growth in Asia will bring about new and increasing demands for products and funds for investment. With its close geographical proximity and reputation for high-quality good and services, Northern Australia is well positioned to meet these demands but it must act fast to leverage this advantage.

Source: Kharas, H. 2010, Working Paper No 285:

The emerging middle class in developing countries, OECD Development Centre.

What are the opportunities for Australian businesses?

In the Northern Australia White Paper, the Australian Government identified five industry pillars which would directly benefit from a reduction in development and regulatory barriers and have the most potential for growth in the region. These industry pillars are:

- food and agribusiness;

- resources and energy;

- tourism and hospitality;

- international education; and

- healthcare, medical research and aged care.

Below is a brief outline of investment opportunities available within these industries.

Food and Agribusiness

The middle class boom has led to a rising demand for animal protein, dairy products and fresh fruit and vegetables in Asia, especially China. The main driver for this is the surge in demand for food that is safe, convenient and produced in a sustainable manner. When combined with the increasing preference for Western food in Asia, this plays to Australia's strengths as its "Australian Made" products are often associated with a reputation for quality and safety.

A widely discussed product with increasing demand is beef as experienced recently with rising world pricing. Meat & Livestock Australia has reported that Australian beef export to China surged six-fold between 2013 and 2015. Rabobank has forecasted that Chinese consumers will demand an extra 2.2 million tonnes of beef per year by 2025. The reason for this surge in demand is not only that Chinese consumers are concerned for the safety of their own food, but also the shifting of their diet from pork to beef.

Resources and Energy

Despite the softening of global mining commodity prices, mining will continue to be a major driver of the region due to world-class deposits in Northern Australia. In late 2016, the Foreign Investment Review Board approved a $30m Chinese investment in Northern Minerals Limited. This fund would enable Northern Minerals to begin construction of a mining plant over a dysprosium deposit at Browns Range in Western Australia, with the anticipation of developing it as the world's first significant producer of dysprosium outside of China. Dysprosium is used in permanent magnets for clean energy and high technology solutions, and with developed countries gradually shifting into clean energy, the European Commission has reported that the demand for dysprosium will double by 2020.

Tourism and Hospitality

In the tourism market, Cairns has benefited directly from the increased direct flights from Japan and China. Northern Australia offers unique tourism investment opportunities including islands on leasehold, resorts, nature-based experiences and developments, high-end ecotourism, cruise terminals, convention facilities and recreation activities. This is not to mention the world class World Heritage Kakadu National Park and unique wilderness areas.

International Education

In 2016, Australia cemented its position as an international education destination of choice with student numbers increasing by more than 10 per cent to 554,179 students.

In the Department of Education & Training's survey of over 65,000 international students, 74% responded that Australia was their first choice for overseas study. Considering the emerging middle class is expected to increase six-fold by 2020, this represents an unprecedented area of opportunity for Australia's international education market - particularly in Northern Australia where quality education is only a short flight away for students from Asia which already has significant skills shortages.

Healthcare, Medical Research and Aged Care

According to the White Paper, Northern Australia is in a unique situation where it can leverage world class medical research teams with a large biosphere in the tropics to position itself as a leading hub for the development of tropical medicine.

The demand for healthcare is a constant, unlike many other industries with a tendency to go through boom and bust cycles. In the next few decades, Asia's burgeoning middle class is expected to be more willing than ever to pay top dollar for premium healthcare products, services, facilities and care.

How KWM can help?

Our cross-practices teams at KWM understand the inbound channels available for foreign investment and the regulatory challenges that may occur. Our Brisbane office is conveniently close to Northern Australia and we have full spectrum capacity to assist on development projects for both onshore and offshore clients. Please contact us if you would like to discuss how we can assist you.