KWM INSIGHT SERIES – CRITICAL MINERALS

The Federal Government's commitment to fostering a Future Made in Australia is set to introduce significant incentives for businesses engaged in the critical minerals sector. The announcement of the Critical Minerals Production Tax Incentive (CMPTI) within the 2024-25 Federal Budget heralds a strategic move to bolster economic resilience and security.

After the close of the first round of consultations, we delve into the preliminary details of eligibility and the key areas that await further clarification – especially relating to the operation of the Community Benefit Principles. Other elements would benefit from further consultation, including the relatively early deadline for final investment decisions (30 June 2030). Questions remain as to whether it can have the intended impact, given some uncertainties.

We are watching as the regulation evolves and will keep you updated.

The most obvious area where Australia has a role to play at the global level is in the supply of critical minerals, essential to decarbonisation, infrastructure, and Defence. Australia is one of only a few countries around the world with the natural resources, industry expertise and trusted trading relationships to fill this role. Expanding our production provides geostrategic value to Australia and key trading and national security partner."

- Dr Steven Kennedy PSM, Secretary to the Treasury, 19 June 2024

- The Critical Minerals Production Tax Incentive (CMPTI) is a $7 billion component of the Future Made in Australia plan aimed at supporting the critical minerals processing sector.

- Eligibility details and the delivery mechanism for the CMPTI (through a refundable tax offset) were outlined in the first round of consultation.

- There remain unanswered questions around broader eligibility criteria, specifically how they align with the Community Benefit Principles.

- Further consultation is needed to address key areas such as eligible outputs, eligible facilities, community benefit principles and eligible expenditure.

- The CMPTI legislation is still pending, with its introduction to Parliament not anticipated in the near future.

- Businesses should prepare for additional reporting obligations and potential compliance costs associated with the CMPTI.

- Industry feedback and ongoing consultation will shape the final details of the CMPTI, with a focus on ensuring the incentive effectively supports the intended economic resilience and community benefit outcomes.

Background to the CMPTI

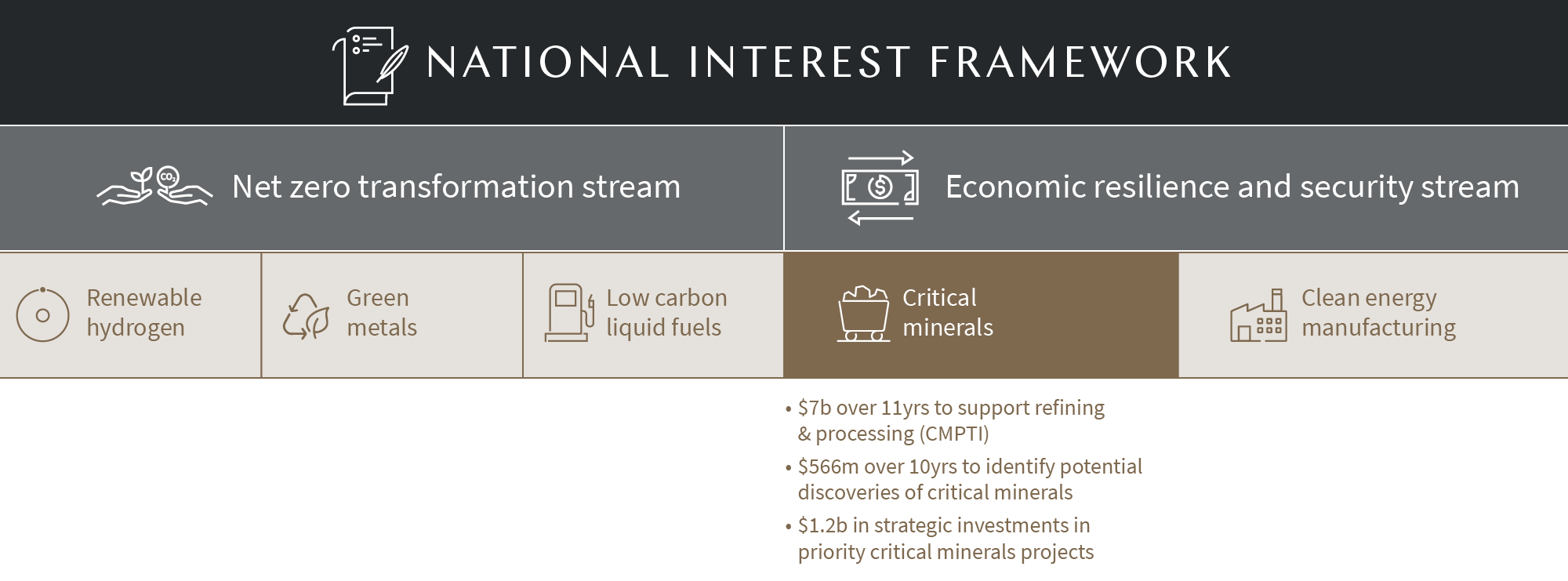

The Federal Government announced in the 2024-25 Federal Budget that it will invest in a Future Made in Australia plan. The Future Made in Australia package includes support for investment in critical minerals processing as one of five industries aligned with the National Interest Framework (others include renewable hydrogen and green metals). Critical minerals sit within the ‘economic resilience and security stream’, one of two streams in the framework (the second stream is ‘net zero transformation’). The framework is contained in the Future Made in Australia Bill 2024 (Bill) introduced into Federal Parliament on 3 July 2024.

Details of the critical minerals announcements contained in the 2024-25 Federal Budget are here and here. This package includes the CMPTI, valued at $7 billion. The CMPTI is the largest initiative within the package, which also includes funding to map Australia’s resource endowments to identify potential discoveries of all critical minerals.

Click to expand image

Details revealed from the consultation – including ‘refundable tax offset’ status

The first round of consultation in respect of the CMPTI closed on 12 July 2024. The discussion in the consultation paper – and the questions posed in it – is a useful starting point in understanding the scope of the CMPTI. Amongst other things, detail is provided as to how the CMPTI will be delivered through Australia’s tax system as a refundable tax offset (with the ability for entities to also adjust their Pay As You Go instalment rate based on the expected credit where they are in a tax payable position).

However, for now, much of the detail regarding the eligibility requirements of the CMPTI has not been provided. This includes broader eligibility requirements that align with the Future Made in Australia Community Benefit Principles. The principles are intended to ensure projects benefiting from government support deliver the community benefits listed in the Bill in their activities and that Future Made in Australia support is appropriately used, with benefits flowing to the community.

Details yet to come…

We set out below some of the key areas for further consideration. We are hopeful that the Federal Treasury will address these vital aspects in further rounds of consultation given the Federal Government is not expected to introduce a Bill into Parliament to establish the CMPTI for some time. The finalisation of the outstanding details should aim to ensure the CMPTI is directed to those industries and mineral products where it is most likely to have the intended impact.

Eligible outputs

Separate consultation will look at specific (eligible) outputs resulting from the refinement and processing of the critical minerals within the scope of the CMPTI. Similar to the approach the United States is proposing in respect of its Advanced Manufacturing Production Credit (AMPC), the establishment of specified outputs is expected to be done through regulations. For example, the list may specify that one critical mineral must be refined to a minimum purity of 99.9 per cent by mass to be eligible (eg lithium), whereas another critical mineral may only need to be refined to a minimum purity of 99 per cent by mass – or even lower - to be eligible (eg nickel).

Eligible facilities

There is a question as to why a final investment decision must be made, or production commenced, by 30 June 2030, given the CMPTI will end on 30 June 2040. Given the uncertainty as to whether the CMPTI will ever operate – the Liberal opposition has indicated it will not proceed with the CMPTI in the event of a change of government – and the nature of greenfield projects, the 2030 deadline may not be long enough to capture sufficient projects. This might call into question whether the CMPTI as currently outlined is, in fact, a support that will achieve economic resilience and security by incentivising downstream processing of critical minerals in Australia.

Community Benefit Principles

There are a number of unanswered questions in respect of the Community Benefit Principles in the context of the CMPTI. At a high level, these relate to how, and when, entities wanting to receive the incentive must satisfy the Community Benefit Principles.

The Bill provides that a person or body deciding whether the Commonwealth or a related body should provide a Future Made in Australia support must have regard to the Community Benefit Principles. However, neither the Bill, nor the consultation paper, set out specifics in respect of the CMPTI. Currently, the explanatory memorandum to the Bill provides only that:

[t]he requirement for decision makers to have regard to Community Benefit Principles can be satisfied through further specification of requirements for Future Made in Australia supports on a program-by-program basis, such as by issuing guidance in a Statement of Expectations to an independent authority, implementing specific requirements as part of relevant legislation or program guidelines, or requiring the satisfaction of a Future Made in Australia Plan.

The following matters will be important in respect of the CMPTI:

- Identity of the decision maker: Which decision maker will be required to have regard to the Community Benefit Principles?

- Timing of the decision: When will the decision maker be required to have regard to the Community Benefit Principles? For example, will it be a once-and-for-all type requirement (with the decision maker signing off that the Community Benefit Principles have been, or will be, satisfied, before a particular entity is entitled to receive the CMPTI), or will it be a year-by-year requirement? If it’s the former, will there be a clawback of the CMPTI if a decision is subsequently made that community benefits have not been provided consistently with the Community Benefit Principles in one or more income years? Either way, it may be that an entity that wants to receive the CMPTI will need a Future Made in Australia Plan that explains how the provision of the CMPTI to the entity would provide community benefits consistent with the Community Benefit Principles.

- Reporting obligations: What reporting obligations will be required in respect of the Community Benefit Principles, and will they result in a duplication of existing reporting obligations (which are already onerous)? For example, the consultation paper refers to the establishment of transparency and disclosure reporting requirements as part of accessing the CMPTI. Specifically, it is suggested this could take the form of a requirement for recipients to demonstrate compliance with their tax obligations. These could be modelled on existing requirements, which suggests they might not be precisely the same. This raises the possibility that additional systems will need to be developed by eligible entities to capture additional data for reporting purposes.

There may be some challenges with linking the Community Benefit Principles to a tax measure such as the CMPTI. In the absence of certainty about the matters above (and other related matters), there is a question as to whether the CMPTI will achieve its intended purpose.

Eligible expenditure – what will it include and is the compliance burden too high?

The CMPTI will be available at a rate of 10 per cent of eligible processing expenditure incurred by an eligible entity. Some have raised concerns over what will constitute ‘eligible processing expenditure’.

For example, it is proposed that eligible processing costs will exclude indirect costs, or costs that are incurred regardless of the level of processing, such as raw materials, product marketing, financing costs, capital works and depreciation. The consultation paper provides that this is to ensure public investment is targeted at the value-adding downstream processing activity and avoids support for costs incurred regardless of the level of processing. Depending on the mineral and process involved, the CMPTI may only offset a small proportion of the total costs of producing the downstream product.

In comparison, the AMPC proposes to take into account depreciation and amortisation (being costs attributable to the production of an applicable critical mineral) as costs incurred in producing the applicable critical mineral. It may be appropriate to reconsider whether adopting the approach under the AMPC is more appropriate to encourage, or retain investment in, critical minerals.

Costs will also need to be apportioned to reflect only the expenditure on the processing of eligible critical minerals to the required specifications, and not on the refining of such minerals.

Integrity rules will be developed to ensure activity between related entities is priced on an arm’s length commercial basis. Subject to the design of these rules, it might be necessary to benchmark terms to contracts with third parties. This may involve considerable compliance costs – it may also be near impossible to obtain depending on the availability of such data.

What is next? Watch this space

The initial round of consultation on the CMPTI laid the groundwork for a transformative initiative within Australia's critical minerals industry. While the eligibility criteria and the finer points of the incentive remain under development, the government's intent is to align economic growth with community benefits.

For businesses in the sector, staying informed and prepared is crucial. As further details emerge, we will continue to provide insights and guidance to help navigate the opportunities presented by the CMPTI.