COP29 COUNTDOWN

We talk a lot about global carbon trading markets – yet relatively little about the mechanism by which countries trade emissions reductions. That mechanism - Internationally Transferred Mitigation Outcomes (ITMOs) – is a strategic tool for nations to not only comply with their climate commitments but also to leverage their carbon sink resources effectively.

On the path to COP29 and beyond, the ITMO market is poised for growth, with the potential to move significant financial flows towards sustainable projects and spur innovation in carbon trading practices. It's a space that demands attention from policymakers, businesses and environmental stakeholders alike, as it holds the promise of accelerating our collective journey towards a low-carbon future.

In this insight, we share how the ITMO market under Article 6.2 of the Paris Agreement works. How is it different to other carbon credits? Is there an opportunity for enterprises to participate?

As countries hustle to meet their ambitious emission reduction targets, the ITMO market is gaining traction, offering a novel avenue for nations to collaborate and for enterprises to find new roles in the climate change mitigation challenge.

How NDC and the Article 6.2 Mechanism of the Paris Agreement works

Put simply, if one country reduces its emissions more than required based on its Paris Agreement targets, it can sell the extra reductions to another country that needs help meeting its targets. This trading aims to encourage countries to work together and do more to fight climate change, making it easier and potentially more cost-effective to reduce global emissions.

How emission reduction targets are set: Nationally Determined Contributions (NDC) are one of the core mechanisms of the Paris Agreement, where countries set their own emission reduction targets and implementation plans to address climate change. All parties to the Paris Agreement are required to establish NDC plans, including climate actions post-2020 and setting climate goals, updated every five years[1].

For example, as one of the parties to the Paris Agreement, China has set its NDC targets. These include peaking carbon dioxide emissions around 2030 and aiming to peak sooner if possible, reducing carbon dioxide emissions per unit of GDP by 60%-65% compared to 2005 levels, increasing the share of non-fossil energy in primary energy consumption to about 20%, and increasing forest stock volume by approximately 4.5 billion cubic meters compared to 2005[2]. These goals reflect China's proactive attitude and sense of responsibility in global climate governance.

How countries can buy outcomes: Similar to enterprises achieving carbon reduction targets, countries can also ’purchase’ mitigation outcomes from other countries to achieve their NDC targets in addition to reducing domestic carbon emissions. Article 6.2 of the Paris Agreement provides a decentralized mechanism for intergovernmental trading of mitigation outcomes. Under the ITMO mechanism, countries do not conduct transactions on a unified trading platform but instead design and implement bilateral or multilateral cooperative approaches led by governments. This facilitates the international transfer and trading of greenhouse gas reductions or removal quantities, with the transaction targets also referred to as ITMOs[3].

Where it sits within the Article 6 framework…

https://unfccc.int/zh/process-and-meetings/the-paris-agreement/nationally-determined-contributions-ndcs

https://unfccc.int/sites/default/files/NDC/2022-06/%E4%B8%AD%E5%9B%BD%E8%90%BD%E5%AE%9E%E5%9B%BD%E5%AE%B6%E8%87%AA%E4%B8%BB%E8%B4%A1%E7%8C%AE%E6%88%90%E6%95%88%E5%92%8C%E6%96%B0%E7%9B%AE%E6%A0%87%E6%96%B0%E4%B8%BE%E6%8E%AA.pdf

https://carboncooperation.undp.org/

The role of COPs (UN Conference of the Parties) – what will COP29 in Baku bring?

Article 6.2 of the Paris Agreement only establishes a high-level and general cooperative framework for the ITMO mechanism, leaving most of its operational details to be determined by each Conference of the Parties. The ITMO mechanism has been gradually refined at successive Conferences since 2021 and remains under development.

- COP26 (the 26th Conference of the Parties) held in Glasgow, UK, in 2021 introduced the initial rules for the operation of Article 6.2 — Guidance on cooperative approaches referred to in Article 6, paragraph 2, of the Paris Agreement.

- COP27 held in Sharm El-Sheikh, Egypt, in 2022 made further progress — Matters relating to cooperative approaches referred to in Article 6, paragraph 2, of the Paris Agreement (collectively referred to as ‘Guidance’ along with the Guidance on cooperative approaches referred to in Article 6, paragraph 2, of the Paris Agreement).

- COP28 held in Dubai, UAE, in 2023[4] did not lead to new guidance.

- COP29 is scheduled to take place in Baku, Azerbaijan in 2024. At this year's Bonn Climate Change Conference in Germany, significant progress was made in discussions surrounding Article 6.2, with parties clarifying their positions. As a result, an additional workshop has been planned before November to continue advancing the technical work. Building on this groundwork, COP29 is anticipated to make strides on critical issues including technical specifics, transparency, and the prevention of double counting. These advances are expected to unlock additional funding for national climate plans and adaptation efforts.[5].

Basic Mechanism of ITMO – how does it work?

Avoiding Double Counting

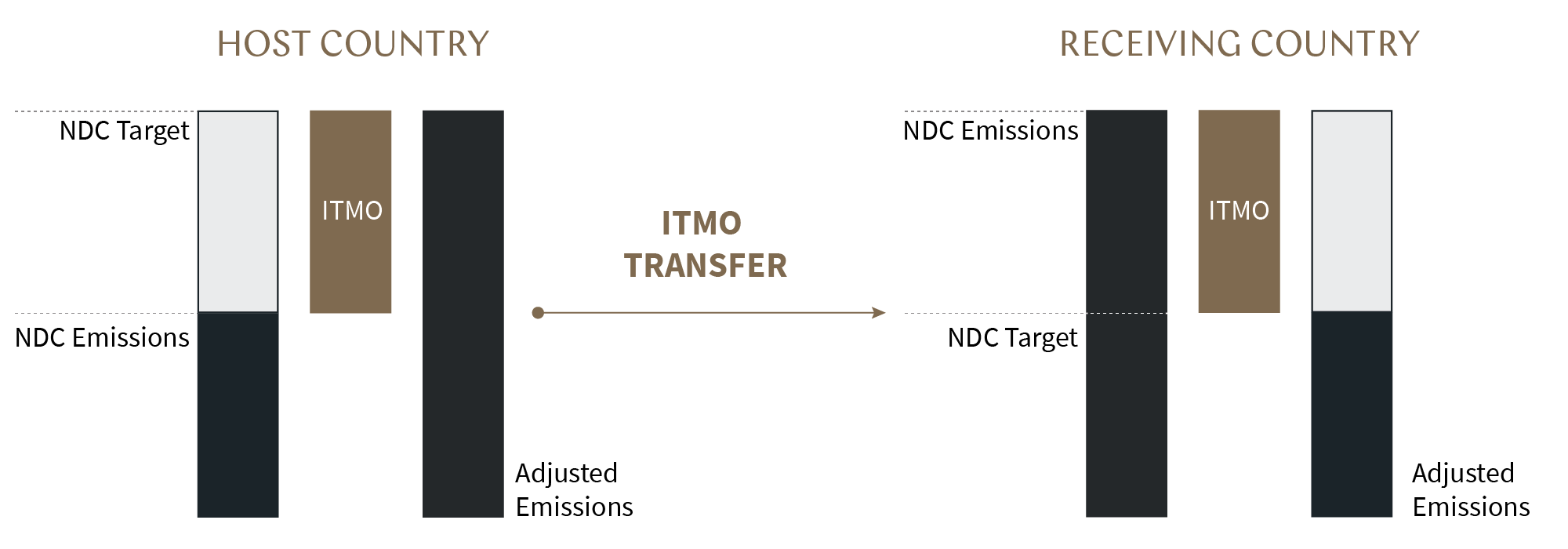

Due to the absence of a unified trading platform, the Guidance establishes an initial framework for accounting and transfer under the ITMO mechanism based on the concept of corresponding adjustments. Simply put, if two parties to the Paris Agreement engage in an ITMO transaction, they must use corresponding adjustments to avoid double counting of national emission reductions across different countries. When the host country of a project transfers ITMOs to another country, it must deduct the transferred reduction amount from its own greenhouse gas emission reduction or removal inventory, and the receiving country of the ITMOs must add the corresponding reduction amount to its greenhouse gas emissions. The following simplified diagram illustrates this principle:

https://unfccc.int/process/the-paris-agreement/cooperative-implementation

https://unfccc.int/news/june-climate-meetings-take-modest-steps-forward-steep-mountain-still-to-climb-ahead-of-cop29

Main Differences Between ITMO and Other Carbon Credits

Some argue that ITMO is a special type of carbon credit[6] [7]. Other regular carbon credits are mainly used for carbon offsetting by enterprises in voluntary and compliance carbon markets. In contrast, the most typical use of ITMO is for countries to achieve their NDC targets under Article 4.2 of the Paris Agreement.

In addition, ITMOs can be used for international mitigation purposes beyond NDCs, such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) by the International Civil Aviation Organization, or for other purposes authorised by the host country's government at the time of the initial transfer[8].

Other Requirements from the Guidance – including reporting and tracking

In addition to the above rules, the Guidance provides recommendations and suggestions for ITMO mechanism participants on how to record and track, report and disclose, make corresponding adjustments to national carbon emission accounts, and regulate the purposes of ITMO use, such as:

- Authenticity, Verifiable and Additionality: Similar to regular carbon credits, the Guidance requires ITMOs to meet the criteria of authenticity (actual occurrence of emission reductions), verifiable (independent third-party verification and certification), and additionality (reductions beyond a baseline)[9]. For specific requirements on authenticity, verification, and additionality, you can refer to our previous article Sleeping Carbon Giant Awakes: China’s Renewed Voluntary Carbon Market is Here – What You Need to Know.

- Establishment of Registries or International Registry: To track ITMOs and provide related information on ITMO holding, transfer, and use, parties need to establish registries or use the international registry provided by the Secretariat[10].

- Reporting by Participating Parties: Parties are also required to regularly submit reports, including initial reports, annual information, and regular information, on the progress of cooperative approaches and the holding and transfer of ITMOs[11].

- Review by UN Technical Experts: UN technical experts will conduct a review of the reports submitted by the participating parties, including a desk or centralized review[12].

The details regarding the ITMO mechanism are still under negotiation and gradual refinement, and mechanisms and practices to ensure the transparency and credibility of ITMOs are also continuously being improved. We will continue to monitor changes and developments in related rules and the market.

Current Status and Models of ITMO Transactions

https://carboncredits.com/the-swiss-thai-carbon-credit-deal-ignites-ev-revolution-in-bangkok/

https://www.whitecase.com/insight-alert/emerging-fundamentals-climate-mitigation-through-itmo-transactions-under-paris

Guidance on cooperative approaches referred to in Article 6, paragraph 2, of the Paris Agreement, Decision 2/CMA.3, Annex, paragraph 1(f)

Guidance on cooperative approaches referred to in Article 6, paragraph 2, of the Paris Agreement, Decision 2/CMA.3, Annex, paragraph 1(a)

Guidance on cooperative approaches referred to in Article 6, paragraph 2, of the Paris Agreement, Decision 2/CMA.3, Annex, paragraph 29 to 31.

Guidance on cooperative approaches referred to in Article 6, paragraph 2, of the Paris Agreement, Decision 2/CMA.3, Annex, paragraph 18 to 24.

Guidance on cooperative approaches referred to in Article 6, paragraph 2, of the Paris Agreement, Decision 2/CMA.3, Annex, paragraph 25 to 28.

Source: UNEP Copenhagen Climate Centre, https://unepccc.org/article-6-pipeline/

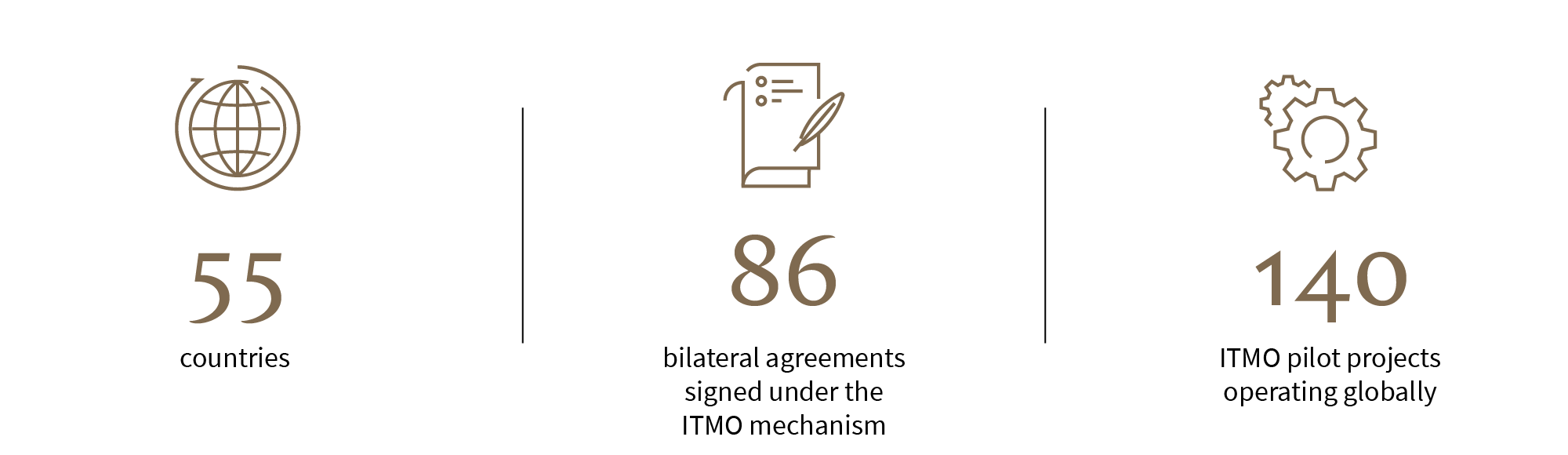

Unlike China's CCER and other systems with centralised trading infrastructure, ITMO transactions do not have a single, centralised global trading market, nor is there a standardised trading method or mechanism. In theory, ITMOs can be traded through bilateral agreements or listed on exchanges, and both trading models have precedents in the market. Publicly available transaction cases include, but are not limited to, transactions conducted between national governments or sovereign funds based on signed bilateral agreements or memorandums of understanding, such as several transaction cases involving the Foundation for Climate Protection and Carbon Offset KliK (the KliK Foundation) and Japan's Joint Crediting Mechanism (the JCM Mechanism).

In the above cases, the receiving country's government first signs an intergovernmental framework agreement on ITMO transactions with the project host country's (transferring country) government.

For example…

- the Swiss government has signed bilateral cooperation agreements with countries such as Ghana, Peru, and Senegal[14]

- the Japanese government has reached bilateral cooperation through memorandums of understanding with countries like Mongolia, Cambodia, and Thailand[15].

These intergovernmental bilateral cooperation agreements or memorandums of understanding set out principled requirements for the authenticity, completeness, and transparency of relevant information and stipulate the development, authorisation, monitoring and accounting of ITMO projects[16] [17].

How can businesses take part?

Although ITMOs are primarily traded and utilised by countries, under certain intergovernmental framework agreements, enterprises can also participate as project developers, operators, buyers or sellers. This provides significant opportunities for businesses to engage in international ITMO transactions.

For example, the KliK Foundation acts as a funder of specific projects and an ITMO purchaser by signing commercial agreements with other enterprises under the framework agreements Switzerland has signed with host countries. Project developers can apply for financial support from the KliK Foundation at specific stages[18], and the KliK Foundation will also purchase ITMOs from these developers as a buyer[19]. Conversely, the JCM Mechanism has established its own registration and trading system (JCM Registry), where both governments and enterprises can open accounts, allowing for the direct transfer of ITMOs between accounts within the JCM system[20] [21] [22].

In addition to the traditional bilateral agreement trading model, new trading models have emerged in the market. For example, the global voluntary carbon trading platform, Carbon Trade Exchange (CTX), has experimented with conducting transactions through auctions for the first time. The ITMO auction held by CTX began on July 16, 2024, and ended on July 23, 2024. The government of Malawi, as the seller, issued 1.5 million carbon credits with a starting bid price of 10 USD per credit. Although the auction has ended, the final sale price and specific buyer information have not yet been disclosed.

Since the current rules do not clearly prescribe ITMO trading practices, it is believed that with future market development and innovation, more trading, financing, and business models will emerge, leading to increased participation in ITMO trading.

Outlook for the ITMO Market

From the demand side…

ITMO, although still nascent, has enormous growth potential. Considering that the primary use of ITMO is to achieve national NDC targets, and many countries have set their NDC targets around 2030, the demand for ITMO could reach new heights by then. According to the Taskforce on Scaling Voluntary Carbon Markets, to achieve the global goal of limiting warming to no more than 1.5 degrees Celsius, global carbon emissions need to be reduced by 23 billion tons by 2030, with approximately 2 billion tons coming from carbon sinks and carbon removal. This requires the global voluntary emission reduction market to grow 15 times from its 2019 level by 2030. Based on this estimate, the global voluntary carbon market could be valued at 30 to 50 billion USD by 2030[23].

From the supply side…

As demand gradually increases and ITMO transaction cases continue to emerge, more countries with abundant carbon sink resources are beginning to realise the value and benefits ITMO transactions can bring to them, and their willingness to join ITMO development plans is growing stronger. For example, countries such as Ghana and Vanuatu are actively seeking collaboration with countries like Switzerland[24], while Suriname is also actively looking for buyers for its rainforest carbon sink projects[25]. The ITMO mechanism gives tangible economic value to the conservation efforts of these countries, playing a very positive role in encouraging countries rich in carbon sink resources, such as those in Africa, to reduce deforestation.

Additionally, there are ample opportunities for enterprises in the ITMO market. In the ITMO mechanism, while governments are the main participants and key drivers, enterprises can also play important roles. For example, the specific operations of ITMO projects are typically handled by enterprises, including project development, monitoring, and management. ITMOs generally require verification by third-party professional organizations, and enterprises can even act as trading entities, participating actively in the ITMO mechanism.

What to expect?

Although negotiations over Article 6 of the Paris Agreement are still ongoing, market demand has already driven transactions under the ITMO mechanism to commence. While we focus on China's CCER trading platform and other mature carbon credit issued by international platforms like Verra and Gold Standard, it's also important to closely track and understand the international agreement-based intergovernmental carbon credit trading mechanisms.

On one hand, we hope that the existing principled framework of the ITMO mechanism can gradually improve to ensure the authenticity, additionality and uniqueness of ITMOs, ultimately advancing global climate goals.

On the other hand, the current principled provisions concerning the ITMO mechanism have, to some extent, created ample space for various entities to participate in the ITMO mechanism and innovate ITMO trading models. With the active participation and innovation of countries and enterprises, the ITMO mechanism is expected to play a greater role in the future, facilitating the prosperity and sustainable development of the global carbon market.

We are watching developments and will keep you informed.

https://www.bafu.admin.ch/bafu/en/home/topics/climate/info-specialists/climate--international-affairs/staatsvertraege-umsetzung-klimauebereinkommen-von-paris-artikel6.html

https://www.jcm.go.jp/about

Bilateral cooperation agreements signed by Switzerland, such as Cooperation Agreement Between the Swiss Confederation and the Republic of Ghana towards the Implementation of the Paris Agreement

Cooperation memoranda signed by Japan, such as Low Carbon Development Partnership between the Japanese side and the Mongolia side

https://www.klik.ch/en/international/participation

https://www.klik.ch/it/news/news-article/klik-foundation-signs-worlds-first-purchase-agreement

https://www.jcmregistry.go.jp/contents/JP/Summary/Entity_holding_accounts.pdf

http://carbon-markets.env.go.jp/document/20240517_JCM_goj_eng.pdf

Guidelines for the Implementation of the Joint Crediting Mechanism (JCM) in Japan

Taskforce on Scaling Voluntary Carbon Markets: Final report

https://www.undp.org/geneva/press-releases/ghana-vanuatu-and-switzerland-launch-worlds-first-projects-under-new-carbon-market-mechanism-set-out-article-62-paris-agreement

https://www.reuters.com/sustainability/sustainable-finance-reporting/suriname-seeks-30-per-credit-first-paris-agreement-carbon-sale-minister-2023-10-10/