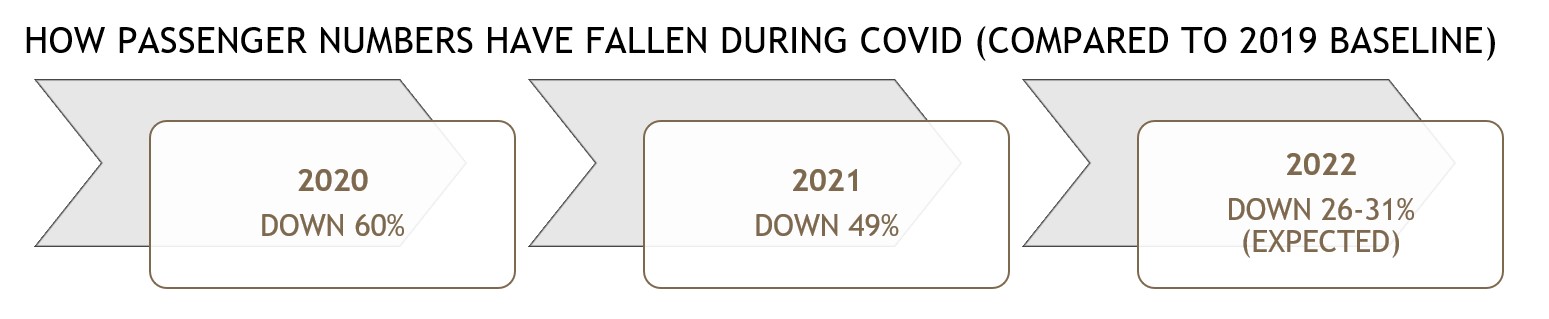

The global aviation industry contributes around 2.1% of all human-induced carbon dioxide (CO2) emissions – more than those produced by most countries, including Germany and Australia. After experiencing their worst crisis due to the COVID-19 pandemic, airlines are accelerating efforts to achieve net zero emissions by 2050 and fuel a ‘green’ recovery.

Sustainable aviation fuels have emerged as one of the most critical aspects of transforming the hard-to-abate sector, and there is also an important role for green and sustainability-linked finance in funding the transition. Carbon offsetting, already widely used, is likely to become compulsory in major jurisdictions in the near future.

Beyond evolutions in operations and financing, the transformation is changing relationships across the industry and throughout the supply chain. Opportunities for cross-border carbon emissions trading with countries like China will emerge and collaboration is becoming increasingly important.

In this insight, we explore the trends and how industry players are responding. For passengers, the shifts under way present an opportunity to choose lower carbon flights. For members of the aviation industry, the changes are unavoidable. Understanding them early – and preparing – are crucial.

Source: ICAO

Global green and sustainability targets in the aviation industry

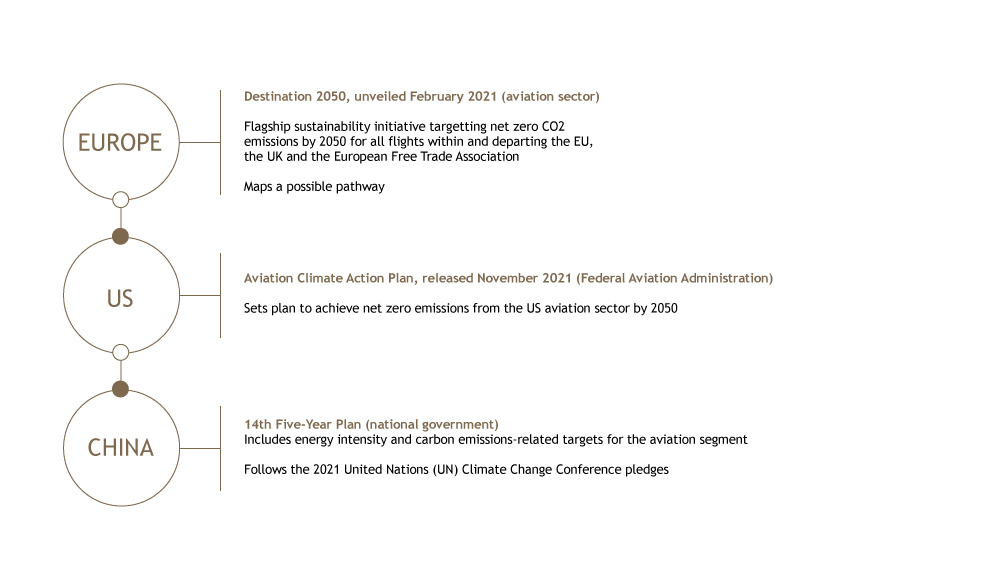

Major economies have made significant commitments to reduce carbon emissions and promote sustainability initiatives in the aviation sector over the past 18 months.

Europe’s aviation sector unveiled its flagship sustainability initiative in February 2021. In the following month, China released its 14th Five-Year Plan featuring carbon emissions targets for the first time – including for aviation. Six months later, the US administrative body released its Aviation Climate Action Plan. Then in January 2022, the Civil Aviation Administration of China (CAAC) issued the 14th Five-Year Civil Aviation Green Development Plan, which is the first ever development plan tagged with 'green development' in Chinese civil aviation history.[1]

Various action plans and initiatives across the industry have identified sustainability measures to cut CO2 emissions but the one that is expected to achieve the highest gains to reach the 2050 fly net zero target – around 65% – is Sustainable Aviation Fuel (SAF)[2].

Sustainable fuels as the dominant force in meeting targets

The global drive to develop SAF is strengthening. The Air Transport Action Group (ATAG) has developed targets to cap carbon emissions and drive the use of SAF. The United Nations’ International Civil Aviation Organisation (ICAO) has acknowledged the need to develop and deploy SAF.

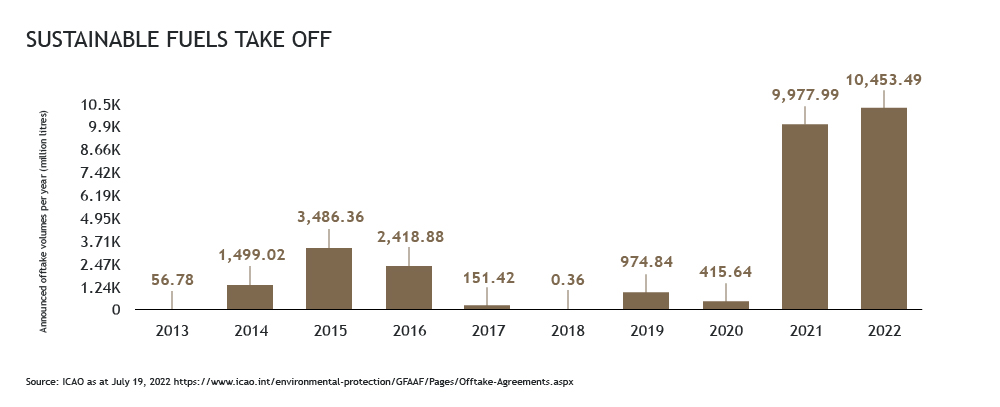

In the first seven months of 2022, sustainable offtake deals covering more than 10 billion litres of fuel were announced – a dramatic increase compared to volumes supplied over the past decade.

In June, ICAO launched its SAF related programme to help build capacity for and deepen understanding of SAFs. This gives member states the opportunity to develop and deploy sustainable fuels – particularly to ensure developing nations are brought on the journey.

The tyranny of distance makes the aviation industry indispensable for Australia, as it is for much of global passenger transport more widely - according to ATAG figures, 80% of emissions are from flights of 1,500+ kilometres 'for which there is no practical alternative mode'.

Yet the sustainable fuels increasingly used for flights and critical to the net zero transition are produced outside of Australia. This means millions of tonnes of feedstocks produced by its agricultural industry – like canola – are sent elsewhere before returning in fuel form. Qantas Group and Airbus want to change that.

In June 2022, the Australian-based airline and the European aerospace company announced a joint investment of up to USD200 million to fast-track a commercial-scale SAF industry in Australia. The initiative is part of the recent order by Qantas of a new fleet of lower emission aircraft from Airbus.

Commercially viable, local initiatives will have to meet strict environmental sustainability criteria to access funding. Funding will also go to research and development.

Engine maker Pratt & Whitney is also contributing and Qantas is gauging the interest in SAF offsets among major corporate customers.

Qantas is targeting a 2030 fuel mix that includes 10% SAF.

In 2021, Airbus performed its first 100% SAF test flight and is targeting 100% SAF use on its current commercial aircraft by 2030.

The role of green or sustainability-linked financing

Green or sustainability-linked financing has emerged as a new trend in supporting a lower carbon economy. It serves as a reward for lessors, lenders, airlines or airport operators selecting sustainable aviation products.

In 2019, Swedavia became one of the first airport operators in the world to issue a green bond loan. The SEK1 billion issue focused on investing in renewable fuels and the electrification of ground vehicles and equipment. In 2022, the Hong Kong International Airport published its sustainable finance framework, ahead of issuing a USD1 billion five-year green bond.

The fundamental determinant of a green loan is the utilisation of loan proceeds towards green projects, under recommended guidelines. Known as the Green Loan Principles, the guidelines were developed by the Loan Market Association (LMA), the Loan Syndications and Trading Association (LSTA) and the Asia Pacific Loan Market Association (APLMA) and published in February 2021.

Although the definition of green projects may vary geographically, because aviation is traditionally a heavy-polluting industry it is reasonable to anticipate that lenders will set the criteria for a 'green loan' in an aviation context restrictively, and a green loan in the aviation sector is anticipated to achieve benefits beyond purchasing new generation aircraft.

In March 2022, LMA, APLMA and LSTA published the guidelines on loans supporting environmentally and socially sustainable economic activity, known as Sustainability-Linked Loan Principles. The focus is on incentivising the borrower’s efforts to improve its sustainability profile, by aligning loan terms to performance against mutually agreed, material and ambitious pre-determined sustainability performance targets. Clearer credentials and greater flexibility in loan proceeds use for sustainability-linked loans make loans more accessible to the aviation sector.

The availability of uniform classification systems of sustainability activities will also help promote reporting and investment marketing with the relevant criteria. The EU Taxonomy is a key example, establishing an EU-wide framework intended to provide businesses and investors with a common language to identify environmentally sustainable economic activities.

Aviation’s global carbon market: CORSIA

International flight operators who are unable to cut CO2 emissions by SAF or other technological and operational improvements can turn to the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

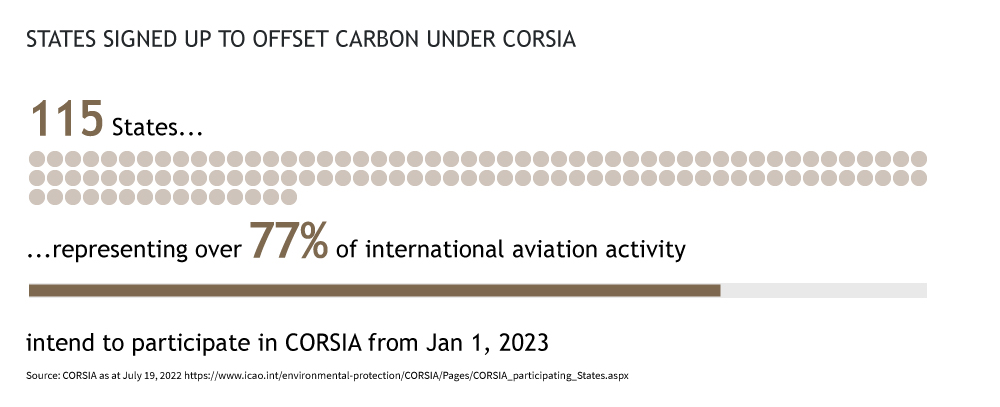

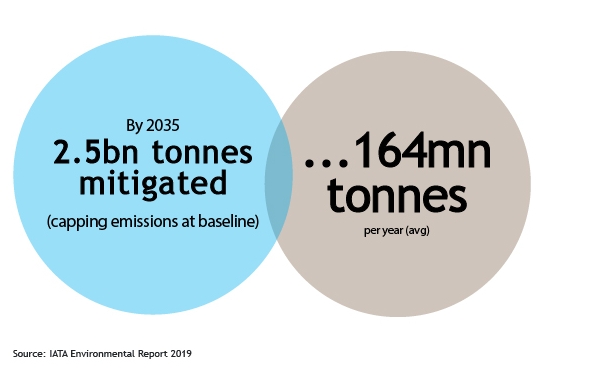

The initiative is currently voluntary but this will soon change. From 2027 onwards, CORSIA will shift from its voluntary pilot (2021-2023) and first phase (2024-2026) into its compulsory second phase (from 2027 through 2035), when all states must comply (subject to certain exceptions).[3]

Developed by ICAO, CORSIA is designed to achieve the goal of carbon-neutral growth. Essentially, it is a global market-based measure to offset emissions. Operators are required to cancel out their emissions. They can do this by purchasing eligible emission units of other industries in the carbon market or using CORSIA eligible fuels. Each emission unit represents one tonne of CO2 emissions reduced.[4]

CORSIA applies to:

- international flights only, and

- aviation operations with annual emissions of CO2 of at least 10,000 metric tonnes or

aircraft with 5,700 kg or more of Maximum Take Off Mass (MTOM)[5].

For aviation activities covered by the scheme, a route-based approach applies. When both the departing and destination states are participating states, CORSIA will apply to the route, regardless of whether the operator itself is based in a non-participating state.

China is a non-participating state, but airlines based in China that fly on routes between participating states will still be subject to CORSIA, due to the route-based approach.

Cross-border carbon emissions trading with China: opportunities

Although it is not a CORSIA member, China is a member of ICAO and has an action plan under ICAO to limit and reduce CO2 emissions from international aviation.[6]

Opportunities for cross-border trading are set to commence this year following the expected restart of registration for China Certified Emission Reductions (CCERs) - domestically certified voluntary carbon credits.[7] CCERs are eligible for offsetting carbon emissions under CORSIA and a national CCER platform is expected to launch for trading on the Beijing Green Exchange. Foreign investors do not currently have direct access to such exchange, but this is anticipated to change over time.[8]

How to calculate the offsetting requirement?

From 2021 onwards, international aviation CO2 emissions are compared against a ‘baseline’ calculated as the industry average of total CO2 emissions in 2019.[9] The total emissions in a year that exceed the baseline must be offset.

- Larger airlines will carry a greater share of offsets initially. From 2021 to 2029, a ‘sectoral’ approach is adopted, using global average growth of emission levels by the international aviation sector to calculate the offsetting requirement of individual operators. The sector’s CO2 emissions increase will have a larger weighting in the offset calculations, and larger airlines may need to offset a greater share of that increase than they are directly responsible for.

- Beyond 2030, operators must monitor emissions and report data. From 2030 onwards, an ‘individual’ approach will apply alongside the ‘sectoral’ approach, meaning an individual operator’s emission growth will also be taken into account to calculate the offsetting requirement (the ICAO Assembly will determine the exact percentage of individual approach and sectoral approach in 2028). The shift will take place gradually (from at least 20% individual approach in 2030-2032; and moving to at least 70% in 2033-2035).

As such, it is crucial for the operators to monitor their CO2 emissions properly and report the corresponding data accurately.

Under CORSIA, offsetting is done through the purchase and cancellation[10] of emissions units arising from emissions reductions (or credits) programmes and projects. The buying and selling of eligible emissions units occurs on carbon markets.

Concerns

CORSIA has a number of challenges. CORSIA does not encompass the carbon emissions from domestic flights and there has been a lack of participation from notable markets such as China and India.

In addition, the International Air Transport Association (IATA) analysis shows that the offsetting costs are expected to have a much lesser impact on international aviation than that caused by fuel price volatility. As such, and considering fuel remains one of the largest operating costs for airlines, airlines may be more incentivised to offset the carbon emissions than to reduce them. CORSIA has already taken into account the impact of the increased costs by phased implementation and exemptions as well as distribution of offsetting requirements among airlines. It remains to be seen how the scheme will achieve the goal of reducing carbon emissions in a cost-efficient manner.

How can industry players prepare?

Financiers: benchmark and link performances

Airports: business partner initiatives

Airlines: consumer-driven campaigns, emissions transparency and more

Collaboration key to an industry facing seismic shifts

While offsets and technology changes are important parts of the journey, the future rests heavily on the use of SAFs.

Above all else is a theme of collaboration. When more than 300 representatives and policy makers met at an Aviation Summit in May 2022, the event culminated in a pledge connecting the challenges: expedite the recovery, promote environmental sustainability and support inclusive innovation. Hosted by the Singapore Changi Airport, the event was appropriately held at the Sands Expo and Convention Centre – Southeast Asia’s first certified sustainable venue.

The industry is working together on the trickiest challenge it has faced: not only cutting carbon but doing so in an uncertain economy.

Daphne Tso (Associate) contributed to this featured insight

Want to know more? Our experts have written more on related topics, including other trends in the transition to net zero:

SUSTAINABILITY: A ROADMAP FOR GROWTH IN ASIA

WHEN CLIMATE CHANGE AND FOREIGN INVESTMENT COLLIDE

'FAKE MOVERS’, ‘GREENWASHING’ ON UNITED NATIONS RADAR: HOW TO RESPOND

References

[1] Interpretation on Notice of CAAC regarding 14th Five-Year Civil Aviation Green Development Plan issued on 27 January 2022.

[2] Net zero 2050: sustainable aviation fuels by IATA.

[3] States that have an individual share of international aviation activities in revenues tonnes-kilometres (RTKs) in 2018 above 0.5% of total RTKs or whose cumulative share in the list of states from the highest to the lowest amount of RTKs reaches 90% of total RTKs shall comply with CORSIA in the compulsory phase, except for the Least Developed Countries, Small Island Developing States and Landlocked Developing Countries (unless they volunteer to participate), see Frequently Asked Questions related to CORSIA as of May 2017.

[4] For more details regarding eligible programmes for the purpose of fulfilling the standard of CORSIA eligible emission units, see ICAO document on ‘CORSIA Eligible Emissions Units’. Examples include the UNFCCC’s Clean Development Mechanism allowing emission-reduction projects in developing countries to earn certified emission reduction credits, which can be traded and sold to industrialised countries in meeting their emission reduction targets.

[5] Consolidated statement of continuing ICAO policies and practices related to environmental protection – CORSIA.

[6] China’s action plan was updated in May 2016, see State Action Plans Submitted to ICAO.

[7] South China Morning Post, What is the China Certified Emission Reduction schedule and why is it important for Beijing’s carbon neutral goal.

[8] In a State Council announcement in November 2021, it was noted that the Beijing Green Exchange will be promoted to host the national trading platform of CCERs and that the exchange will also be open to global investors: http://www.gov.cn/zhengce/content/2021-11/26/content_5653479.htm. For more information on China’s carbon trading market, please see https://www.kwm.com/cn/en/insights/latest-thinking/chinas-carbon-trading-market-a-game-changer.html.

[9] Due to the unprecedented impact of COVID-19, ICAO council agreed to implement a safeguard adjustment to the 2021-2023 pilot phase of CORSIA: the emissions baseline above which international airlines must offset their emissions will now be calculated using only 2019 emissions, rather than averaging 2019 and 2020 emissions. See ICAO Council agrees to the safeguard adjustment for CORSIA in light of COVID-19 pandemic.

[10] “Cancelling” means the permanent removal and single use of an emissions unit so that the same emissions unit cannot be used more than once. This is done after an aeroplane operator has purchased emissions units from the carbon market; see paragraph 2.13 of CORSIA Frequently Asked Questions (updated as of 9 August 2018, “CORSIA FAQ 2018”).

[11] Bloomberg Green, BlackRock joins Allianz, Invesco saying ESG outperformed (18 May 2020).

[12] For example, the Hong Kong Monetary Authority (HKMA)’s Common Assessment Framework requests banks to submit information regarding their status of developing lending policy or investment policy with respect to climate risks (and climate risks includes carbon-intensive sectors), see HKMA, Common Assessment Framework on Green and Sustainable Banking For the position as at 31 December 2019.

[13] National implementing legislation may include enforcement measures which extend liability for CORSIA non-compliance to lessors and/or against the aircraft. More stringent requirements may also be imposed by governmental or official authorities to increase their disclosures on climate and environmental data or impose a lien on and seize an aircraft pending cancellation of sufficient emission offsets for the operator’s entire fleet (similar to the Eurocontrol fleet lien). Furthermore, financial institutions may be subject to public scrutiny or regulatory restrictions regarding the environmental responsibility or sustainability profiles of their portfolios.

[14] Note, however, the reporting periods under CORSIA are annual; see paragraph 3.56 of the CORSIA FAQ 2018.

[15] Operators must submit an emissions report. The data for a given year must be verified by an accredited verifier by 31 March of the following year. Once verified, operators must surrender the equivalent number of allowances by 30 April of that year. See European Commission, Monitoring, reporting and verification of EU ETS emissions.

[16] See European Commission, EU Emissions Trading System (EU ETS).

[17] This is a code assigned by ICAO to operators but not all operators have such a code.

[18] ICAO, Environmental Protection: Volume IV, Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA): Annex 16 to the Convention on International Civil Aviation (1st ed. 2018), at II-1-1.