Driving to a cleaner future with EVs

Electric vehicles (EVs) are poised to sit at the forefront of the global transition to decarbonised mobility.

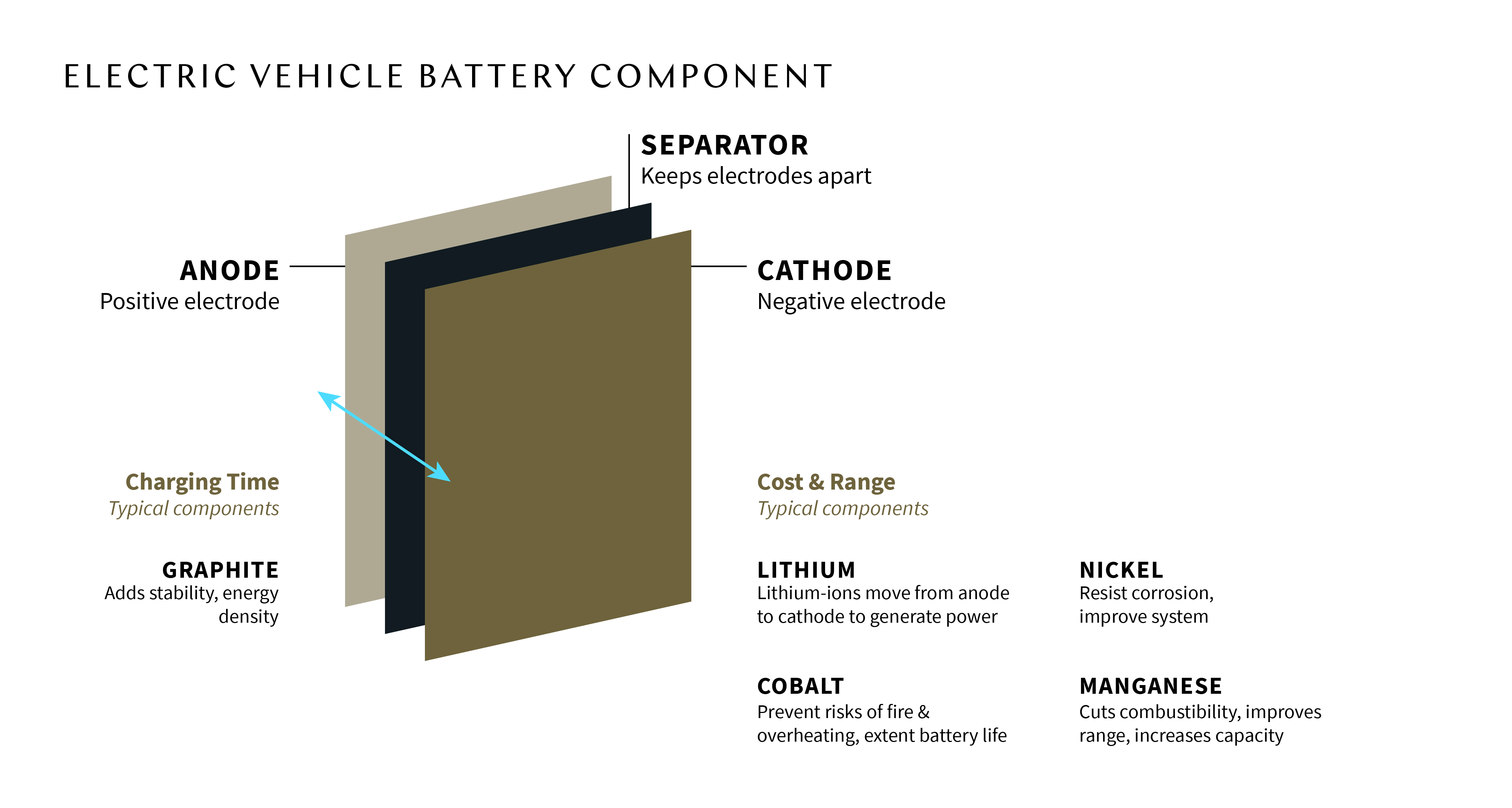

The strong global push to electrify the world’s vehicle population has in turn created exponential demand for the various components comprising an EV, with the most important being its energy source – the battery. The EV battery (and its supply chain) serves as the single most valuable part of an EV, typically accounting for 30% to 40% of the value of the vehicle[1]. This high cost is mainly attributed to the battery’s composition of several critical raw minerals, including lithium, cobalt, manganese, nickel and graphite[2]. As we share below, these minerals are hard to come by and supply is concentrated in the hands of a few countries.

Nickel is a crucial raw material used in the global production of EV batteries. For an in-depth discussion on the facts, trends and issues surrounding the mining and production of nickel in Indonesia, read our first insight published on 12 October 2023 via the following link: https://www.kwm.com/global/en/insights/latest-thinking/indonesias-nickel-rush-riding-the-waves-of-the-ev-battery-revolution.html.

The negative pole of an EV battery is known as the anode, while the positive pole is known as the cathode. The anode is made of graphite, and the cathode is made of lithium, nickel, cobalt, manganese.

The EV industry faces complex challenges in balancing ethical supply chain practices, trade policies and global competitiveness. As nations and companies navigate these issues, strategic partnerships and innovative sourcing solutions will play critical roles in shaping the future of the EV market.

Want to stay up to date with the trends shaping the EV market and the net zero transition more broadly? Subscribe to our climate and ESG content!

Click to jump to the chapter:

The vertical dominance of Chinese companies | US supercharges local supply chains

The EU builds alliances and competitiveness | The global shift: cooperation and innovation

What exactly is the EV battery supply chain?

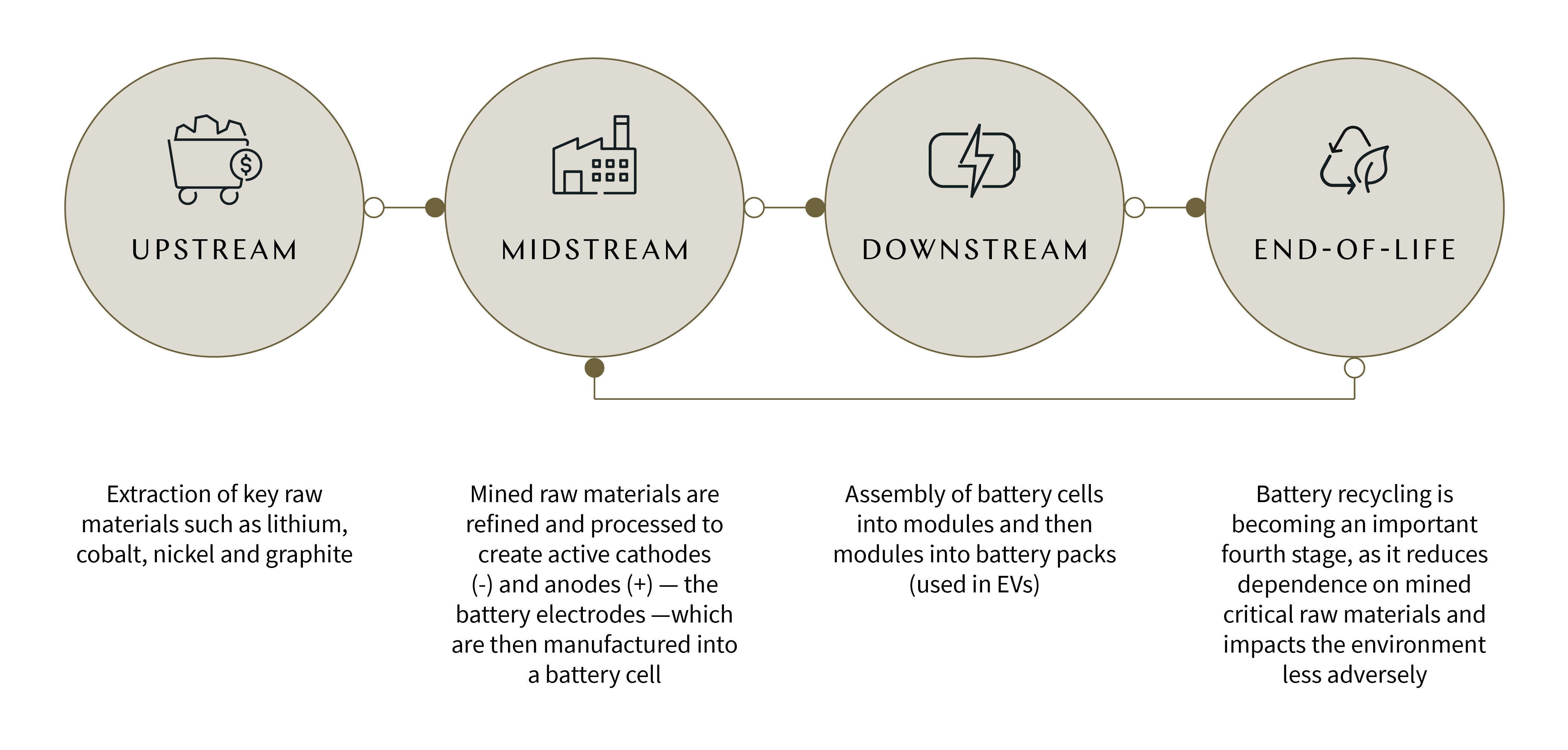

Apart from the usual components that make up a regular car, the battery for an EV car is a core component which encapsulates the entire production life cycle of the EV supply chain: from upstream raw material production to battery manufacturing and, ultimately, end-of-life recycling.

According to Intergovernmental Panel on Climate Change (IPCC) reports (most recently released in 2022[3]), transportation is a major polluter. Almost all (97%) of transportation-induced greenhouse gases emissions come from fuel combustion. In the US, the transportation sector is the largest emitter of greenhouse gases[4]. The IPCC has stressed that EVs offer the largest decarbonisation potential for land-based transport.

The adoption of EVs is a key means of mitigating the effects of climate change. Global sales of EVs reached 13 million units in 2023, up 29.8% compared to 2022[5]. The global demand for EVs is mainly fuelled by:

- a regulatory shift towards sustainability

- increased consumer demand for greener technologies, and

- the impending ban on Internal Combustion Engine (ICE) vehicles in multiple countries over coming years, to achieve new emission-reduction targets.

The EV battery supply chain is extensive and complex due to the multiple players, industrial and commercial sectors and geographies involved. This complexity is further compounded by the scarce availability of critical raw materials at present and the forecasted expectation that current supplies cannot meet predicted demand. Lithium, nickel, cobalt and the other critical raw minerals undergo a swathe of complicated methods of extraction and refinement to transmute into battery components.

Where are EV batteries made? China currently leads global production

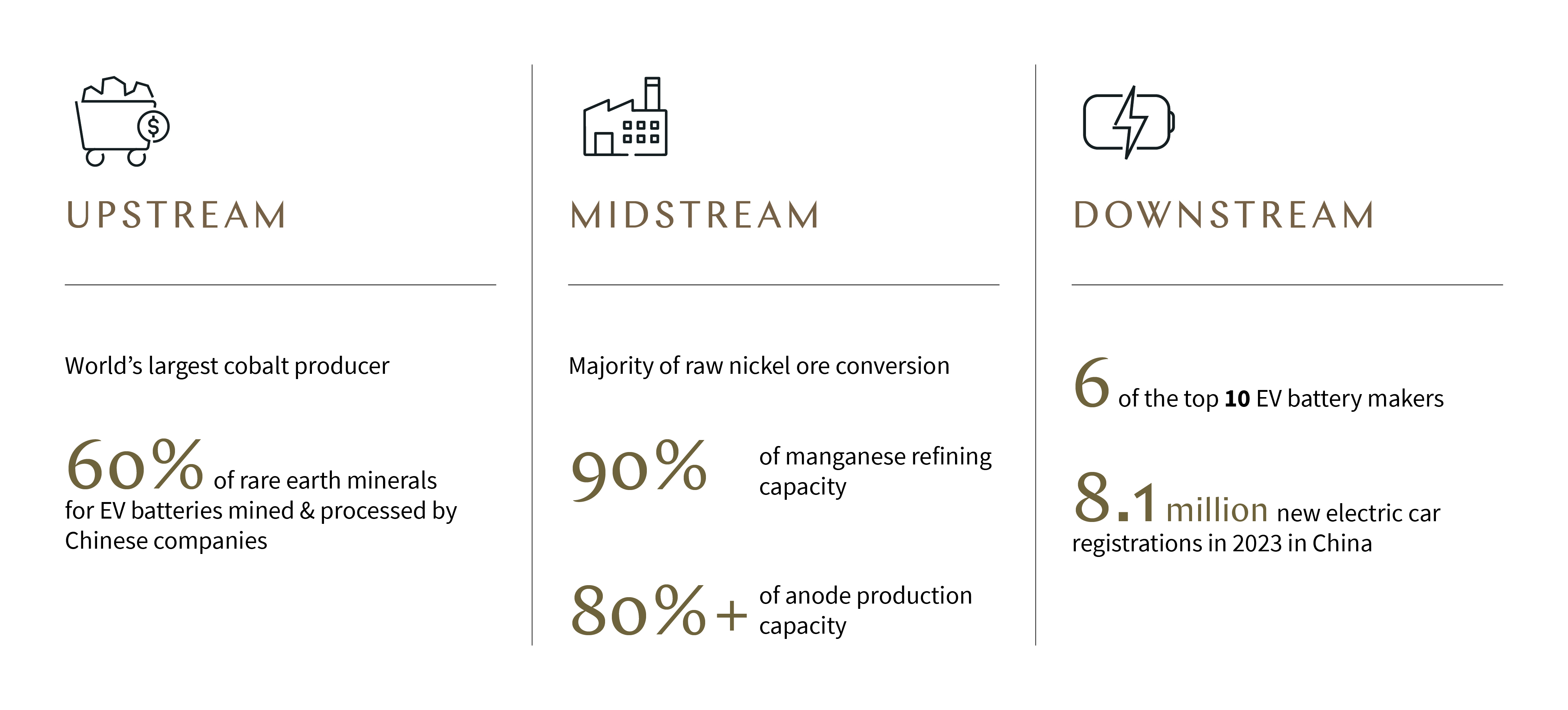

In the global EV battery supply chain, Chinese companies hold the lead.

- China accounts for around three-quarters of all EV batteries along with 70% of production capacity for cathodes and 85% for anodes (both consisting of a mix of critical raw minerals). Chinese companies control more than half of graphite, cobalt and lithium processing capacity.

- US companies account for 10% of EV production and 7% of battery production capacity.

- European companies make up a small part of the supply chain with cobalt processing at 20%.

- Korean and Japanese companies exert considerable influence downstream in raw minerals processing and production of cathode and anode material. Korean companies are responsible for 15% of cathode material production, while Japanese companies account for 14% of cathode material production and 11% of anode material production[7].

International Energy Agency, “Global Supply Chains of EV Batteries” published in July 2022: https://iea.blob.core.windows.net/assets/4eb8c252-76b1-4710-8f5e-867e751c8dda/GlobalSupplyChainsofEVBatteries.pdf

China’s Ministry of Industry and Information Technology pays car companies subsidies based on the number of EVs they produce. Through the end of 2022, the ministry had paid almost 39 billion yuan to subsidise the production of about 3.76 million new-energy vehicles, with BYD getting the highest amount of subsidies.

Giving an example, EV makers are deemed high-tech companies and so pay a lower corporate income tax rate of 15% compared to the standard 25%.

The Ministry of Finance has spent almost 20 billion yuan to promote electric vehicles, including subsidising charging infrastructure. China’s economic planning agency has pledged to subsidise public chargers to meet demand from over 20 million new-energy vehicles by the end of 2025.

The rare earth elements include yttrium, lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, and lutetium.

S&P Global Mobility, “A reckoning for EV battery raw materials” published in October 2022: https://www.spglobal.com/mobility/en/research-analysis/a-reckoning-for-ev-battery-raw-materials.html

S&P Global Market Intelligence, “Manganese sulfate bottleneck looms over US, European EV manufacturers” published in January 2023: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/manganese-sulfate-bottleneck-looms-over-us-european-ev-manufacturers-73926378

S&P Global Market Intelligence, “Manganese sulfate bottleneck looms over US, European EV manufacturers” published in January 2023: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/manganese-sulfate-bottleneck-looms-over-us-european-ev-manufacturers-73926378

Global Business Reports, Mining in Africa Country Investment Guide 2024, published in 2023: https://www.gbreports.com/files/pdf/_2023/MACIG-2024-Prerelease.pdf

Critical minerals

Chinese companies have steadily taken controlling stakes in numerous upstream assets producing nickel, lithium, cobalt, graphite and manganese.

- These chemical elements form the basic building blocks of lithium-ion battery cells and are what gives them the power to store and release energy for propelling electric vehicles.

- Chinese companies hold majority or controlling stakes in many of the leading assets and companies extracting lithium and producing battery-grade lithium products outside the country.

- Tianqi Lithium owns a majority stake in Greenbushes in Western Australia, one of the largest lithium mines in the world, and operates a battery grade lithium hydroxide refinery in the state.

- Heavy Chinese investment has poured into Congo for decades Congo’s rich reserves of cobalt, estimated at 3,600 million tons, comprise more than 50.7% of the world’s cobalt reserves[11]. In 2022, China Molybdenum, the world’s second leading producer of cobalt, invested US$2.5 billion to double its output of cobalt to meet the growing demand. In 2023 it became the world’s largest cobalt producer[12].

Rare earths

Rare earths are just as essential in manufacturing EVs (both the battery and the electric motor).

In fact, rare earth minerals are used in wind turbines, electrolysers and transmission lines that are also needed to hit net-zero goals.

In their natural state, rare earths are a particularly important group of critical minerals that often show up as uniform rocks. They are then separated from the rock itself into multiple rare earth minerals[13]. This process of separation is technically challenging and labour-intensive as these minerals are distributed diffusely and thus difficult to extract in large quantities.

In 1990, the Chinese government declared rare earths as a protected and strategic set of minerals and prohibited foreign firms from mining and smelting them in China. By 2021, China had the world’s largest producer of rare earth minerals, following the merger in December that year of three government-owned rare earth miners.

Chinese companies…

- mine and process 60% of the world’s rare earth minerals used in EV batteries[14].

- accounted for 70% of global mine production of rare earths in 2022, followed by companies from the US, Australia, Myanmar and Thailand

- controlled 85% of the processing (i.e. the separation of minerals from earth rock) in 2022, which essentially means mining countries outside of China inevitably send their mined rare earths to China for processing.

China’s Ministry of Natural Resources declared in January 2023 that the country is ramping up its internal hunt for critically important minerals and energy resources to bolster strategic reserves. This is part of a bid to double down on economic security and stave off the risks associated with relying on external markets. The new policies will encourage investment in mining exploration and give priority to land use for extracting strategic elements[15].

After extraction, the raw minerals are purified by processors and refiners, who use the processed minerals to create cathode and anode active battery materials.

Battery-grade nickel sulphate:

- 11 of the 16 companies that can currently perform the conversion process of raw nickel ore to nickel sulphate are Chinese.

- By 2030 this total number of companies is expected to increase to at least 24, of which 14 will likely be Chinese companies. By that same year, China is forecasted to process 824,000 metric tons of nickel sulphate annually. The US and the EU are forecasted to process 146,000 metric tons[16].

Manganese:

- Together with nickel, essential in the chemistries of an EV battery (in nickel-manganese cobalt cathodes, trending due to lower cost and battery safety).

- Demand for battery-grade manganese is expected to increase by 15 times from 2020 to 2031 to 1.2 million tonnes per year[17].

- Chinese companies hold about 90% of global refining capacity turning manganese ore into high-purity manganese sulphate[18].

Anodes:

- The anode of an EV battery is typically made of graphite coated on copper foil. Graphite makes up 45% of each battery cell and 28% of the entire battery – by far the largest component in both volume and mass[19].

- Chinese companies are the top producers of graphite by a staggering margin, having produced 850,000 metric tons of graphite in 2022 (accounting for 65% of the global total[20]). Madagascar, the second largest producer, produced 170,000 metric tons in the same year[21]. China’s recent policy to curb exports of graphite (as discussed below) serves to reinforce this control.

- In all, Chinese companies possess more than 80% of the world's production capacity to produce anodes in EV batteries[22].

Cathodes:

- Nickel, manganese, cobalt, lithium, iron in their mixed compositions are the main cathode materials of an EV battery.

- Chinese companies’ production capacity for cathodes is set to near 90% by 2030 as they continue to rapidly expand production[23].

Western auto companies like BMW and Renault, among others, assemble their EVs in China. Many depend on Chinese batteries. Historically, China solicited Western know-how to build its car industry. Now Chinese companies are constructing battery plants in Hungary and Germany with Chinese managers working on-site to share their expertise[24].

“It’s clear that [Chinese companies] are very competitive in the electric car value chain. I think they are a generation ahead of us.” Renault chief executive Luca de Meo, on French radio, September 2023[25]

China is home to 6 of the top 10 EV battery makers with 60% market share, led by CATL and Warren Buffett-backed BYD[26].

In China, the number of new electric car registrations increased by 35% between 2022 and 2023, reaching 8.1 million.

In the US, new electric car registrations increased by 40% between 2022 and 2023, totalling 1.4 million[27].

In the first half of 2023, sales of Chinese cars in Australia, including EVs, nearly doubled from the previous year, reaching a market share of more than 16%[28].

In the early 2000s, the Chinese government decided to venture into new territory: cars entirely powered by batteries. This followed the realisation that China’s car industry would never rival and overtake the US, German and Japanese automakers on internal combustion engine innovation.

In 2001, EV technology was introduced as a priority science research project in China’s Five-Year Plan. Subsequent Five-Year Plans have prioritised EV development and the promotion of EV adoption and infrastructure upgrades - mainly to solve air pollution and reduce the country’s reliance on oil and gas.

Through implementing these national and provincial economic plans, the Chinese government has

- offered government subsidies[8] and favourable policies[9] to build up the EV battery manufacturing industry

- reimbursed and waived purchase tax for domestic EV buyers

- helped build and subsidised charging infrastructure[10] (the country had 6.36 million EV chargers at the end of May 2023, more than anywhere else in the world), and

- encouraged provincial governments to convert their public transport electric.

In short, these government initiatives boosted the business of Chinese EV makers and created a domestic mass EV market.

Practical implications of the dominance of Chinese companies in the EV sector

Chinese companies lead the market in the development and implementation of advanced battery technologies and production. These companies are important contributors to the competitive and dynamic nature of the wider EV industry, driving advancements in technology, infrastructure and consumer adoption. Competition between those companies, as much as with foreign manufacturers, has helped to decrease technology costs and improve affordability. These are, of course, important factors in encouraging adoption of the technology and assisting countries with achievement of their green goals.

Contra to the US government’s implicit ban (via the Inflation Reduction Act) on critical minerals originating from China for use in the US EV industry and tightened controls on exports of semiconductors to China (by stopping sales of Nvidia’s advanced artificial intelligence chips[29]), China, as the world’s top graphite producer and exporter, now requires special export permits for certain types of graphite (the raw material essential for EV battery anodes)[30].

Under these new restrictions, China will require exporters to apply for permits to ship two types of graphite which are used in EV batteries: high purity, high-hardness and high intensity synthetic graphite material and natural flake graphite and its products. These curbs are like those implemented by China in August 2023 on gallium and germanium which are key metals used to make semiconductors and electronics[31].

Seeking energy sovereignty

In light of the above, we see an underlying trend in the EV industry as it experiences a wave of collaboration and cooperation. Companies and governments are investing in domestic battery manufacturing and expanding global supply chains to ensure their own energy security (and cushion their heightened energy security concerns):

- Initiatives like the European Battery Alliance and proposed investments in the US are driving the development of competitive battery manufacturing industries.

- Automakers are adopting new business models to control supply chain margins and secure access to minerals supply. For example, Volkswagen and Stellantis have invested in mining companies to acquire mines in Brazil, while Ford, General Motors and Tesla are building their own battery plants and lithium refineries.

- China is expanding manufacturing presence abroad, while strategic partnerships like the Minerals Security Partnership aim to accelerate diverse supply chains.

- Efforts are also being made to diversify sources of critical minerals and explore alternative technologies.

All in all, the industry is evolving rapidly, driven by collaboration, diversification and emerging technologies.

US supercharges local supply chains

The Inflation Reduction Act (IRA)

Signed into law on 16 August 2022, a key focus of the IRA is to amplify the US government’s financial support to the clean energy sector and improve domestic EV supply chains. It does this by encouraging procurement of critical raw minerals supplies domestically or from free-trade partners as well as critical materials processing, refining, and recycling and incentivising domestic production.

Notably, consumers can receive a Clean Vehicle Tax Credit of up to US$7,500 if they buy a new qualifying EV or plug-in hybrid vehicle and up to US$4,000 for a used EV[32]. Eligibility requires a ‘local’ aspect:

- certain critical raw minerals used in the EV battery extracted, processed or recycled in the US or a free trade partner of the US[33], and/or

- battery components manufactured or assembled in the US.

EVs containing minerals extracted, processed or recycled by ’foreign entities of concern’ (FEOC) (which refer to North Korea, China, Russia and Iran) and EV battery components manufactured or assembled by these FEOCs will not qualify for the tax credit. The FEOC rules came into effect in 2024 for completed batteries and will come into effect in 2025 for critical minerals used to produce them.

China has filed a formal complaint with the World Trade Organisation (WTO) against the IRA, saying the legislation is discriminatory and has distorted the global EV supply chain[34]. The US in response has accepted China’s request to hold WTO dispute consultations which are expected to take place in the near future. The US has repeatedly asserted that the IRA is a tool to help the country realise its climate ambitions and transition to a clean energy economy. If no resolution is reached then the last resort would be adjudication by a WTO panel which can result in monetary penalties, trade and/or economic sanctions.

Under the Proposed Guidance[35], a foreign entity is a FEOC if it is…

In 2024, the US Internal Revenue Service plans to expand access to the tax benefit by allowing consumers to choose between claiming a non-refundable credit or transferring the credit to the dealer to lower the price of the car at the point of sale.

The legislation’s list of eligible sources includes countries that have free trade agreements with the US such as Australia, Canada, Chile, South Korea, Mexico and 20 others.

Released by the US DOE on 12 April 2023 (https://www.federalregister.gov/documents/2023/12/04/2023-26479/interpretation-of-foreign-entity-of-concern) and 1 December 2023 (https://www.regulations.gov/document/IRS-2023-0059-0001) defining FEOC under the Jobs Act.

|

…subject to the jurisdiction of a covered nation’s government.

|

…owned by, controlled by, or subject to the direction of a covered nation’s government.

|

|

|

(i) the foreign entity is incorporated or domiciled in, or has its principal place of business in, a covered nation, or (ii) with respect to the critical minerals, components, or materials of a given battery, the foreign entity engages in the extraction, processing, or recycling of such critical minerals, the manufacturing or assembly of such components, or the processing of such materials, in a covered nation. |

(i) 25% or more of the entity's board seats, voting rights, or equity interest are cumulatively held by that other entity, whether directly or indirectly via one or more intermediate entities, or (ii) with respect to the critical minerals, battery components, or battery materials of a given battery, the entity has entered into a licensing arrangement or other contract with another entity (a contractor) that entitles that other entity to exercise effective control over the extraction, processing, recycling, manufacturing, or assembly (collectively, “production”) of the critical minerals, battery components, or battery materials that would be attributed to the entity. |

|

New business ties forming in response to the IRA

Chinese companies are expanding their presence in the form of joint ventures with American automakers.

- Ford is building a US$3.5 billion plant in Michigan that will build batteries using technology from China's CATL.

- Foxconn, which makes the iPhone in China for Apple, is building electric pickups in Ohio after forming a joint venture last year with Lordstown Motors.

- China EV maker BYD is getting serious about building a battery plant in Mexico to establish a foothold in that region[36].

On the international stage, Chinese companies have linked up with Korean firms to take advantage of Korea’s FTA with the US. EV batteries made in Korea then installed in US-assembled EVs will qualify for IRA tax breaks. Five battery materials plants worth about US$4.4 billion have been announced this year by Chinese companies and local partners in South Korea.

- Zhejiang Huayou Cobalt Co agreed to launch a 100,000 ton precursor plant with LG Chem Ltd and a separate high-purity nickel material and precursor plant with POSCO Future M Co.

- China’s GME Resources agreed to build a 50,000 ton precursor plant in partnership with SK On, to start production in 2024.

It remains to be seen whether the Department of Energy (DOE) will allow credits for the resulting EVs.

In any case, noting the DOE guidance that any minerals processed or extracted within China will not be eligible, regardless of ownership, there is uncertainty over how the IRA might impact on the operations of foreign companies in China.

- US company Albemarle is set to complete construction of a 50,000 tonne lithium hydroxide conversion plant in Sichuan province by early next year.

- Chile’s SQM and US company Arcadium Lithium have also both invested in new lithium processing plants in China.

The crux of the issue...

- If the US government deems any form of involvement with Chinese partners on battery-related ventures falls foul or is at risk of falling foul of IRA legislation then it will be difficult for countries other than China to diversify their supply chain (that fulfills US demands for batteries free of Chinese ownership of key components) especially since the majority of upstream production and processing is controlled by Chinese companies.

- The IRA may end up being counter-productive to its stated goal of spurring green transition if no country can qualify. South Korea recognises that Chinese companies control almost the entire EV supply chain so a strict application of the IRA would mean few companies involved in EV manufacturing in the US qualify for the incentives[37]. It may be the case that EV manufacturing firms determine that the cost advantages of Chinese technologies are worth more than IRA tax incentives.

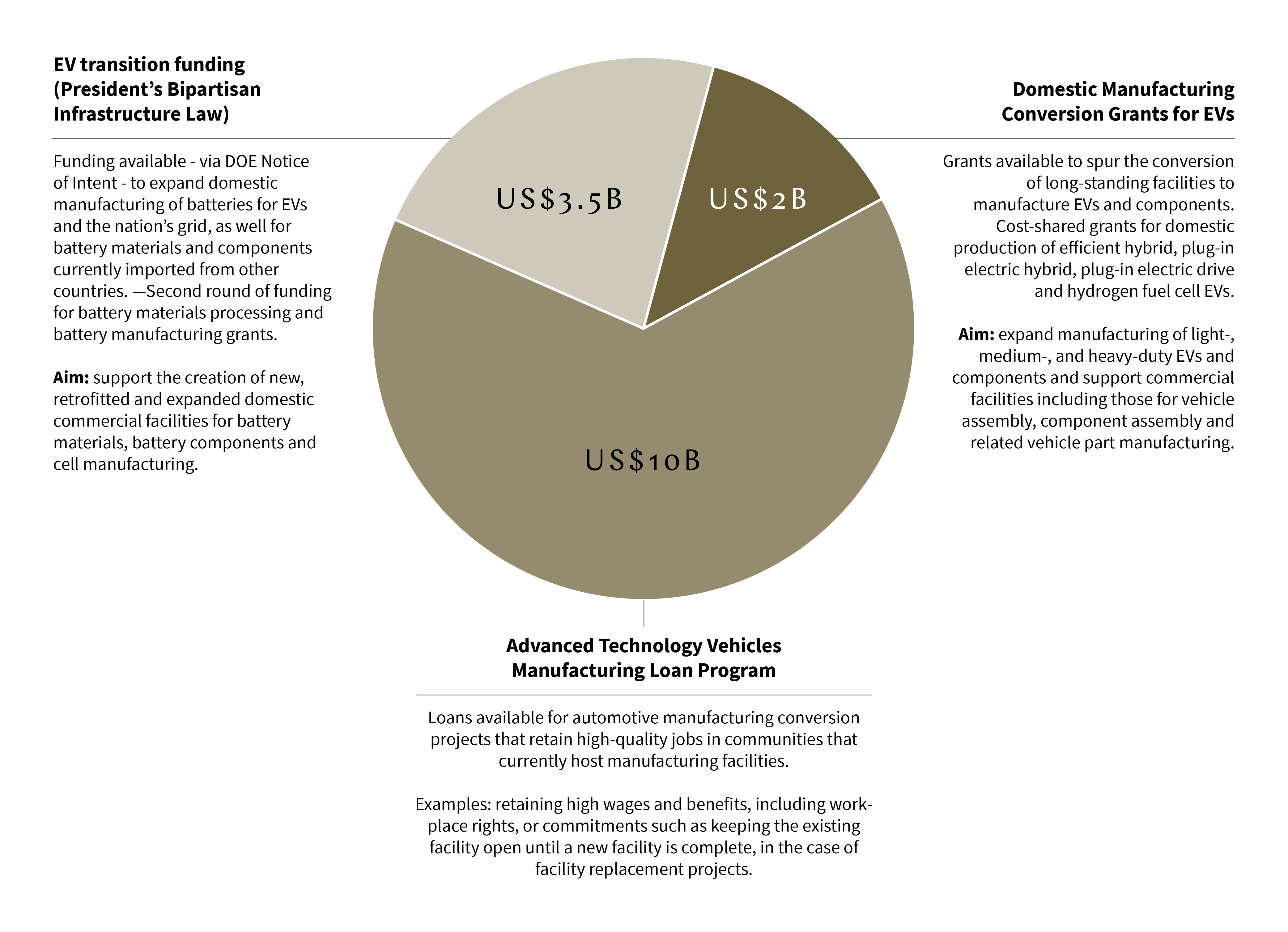

Investing in America initiatives

To further drive innovation and research and secure the domestic battery supply chain, the DOE offers financial incentives including:

- more than US$131 million in funding for projects and an advanced battery consortium to advance research and development in EV batteries that accommodate the needs of EV manufacturers and battery suppliers[38] (announced in January 2024).

- a US$165.9 million loan to finance American Battery Solutions’ production of lithium battery packs. This is just one example of the many private sector investments made by the DOE’s Loan Programs Office, leveraging additional loan authority provided by the IRA to strength domestic supply chains.

- a US$15.5 billion package of funding and loans to enhance the EV value chain, primarily focused on retooling existing factories[39]. This includes...

Policies targeting the Chinese EV and battery industry

US drive to diversify supply chains

Over the past few years, US international policies have steadily grown in scope and intensity to better protect its domestic industries.

The Uyghur Forced Labor Prevent Act (UFLPA)

- The UFLPA came into effect on June 2022 with the aim of preventing companies from profiting from products manufactured using forced labour in the Xinjiang-Uyghur Autonomous Region (XUAR) in China.

- The law pursues this objective by prohibiting the importation into the US of goods with ties to forced Uyghur labour.

Ultimately, automakers may face a hard choice: continue with the more cost-effective upstream supply chain in breach of the UFLPA or take the more expensive foreign route of diversifying away from the XUAR. The latter option is easier said than done considering the world’s largest steel and aluminium producers have shifted to the XUAR hence implicating the steel and aluminium used to make practically every major car part.

US tariffs on imported Chinese EVs

- Most recently, in May 2024 the Biden administration raised tariffs on Chinese EV imports from 25% to 100%, as it intensifies efforts ahead of the US election to protect the American industry from Chinese manufactured vehicles before they can gain a foothold in the US market[40]. The sharp rise in the levies comes amid mounting concern that China could flood the US market with cheap EVs, threatening the American car industry.

- Practically speaking, the IRA restrictions combined with fresh tariffs aim to alleviate market oversupply. This is the same case in Europe with the ports of Antwerp and Zeebrugge inundated with Chinese EVs[41]. On this point, there is no mutual benefit to a trade war which runs counter to both countries’ agreement to advance climate cooperation[42], notably collaborating on greenhouse gas reduction as part of collective net zero emissions targets.

The EU builds alliances and competitiveness

The Critical Raw Materials Act

The EU unveiled its own Green Deal Industrial Plan in February 2023 to promote the competitiveness of EU countries. The Critical Raw Materials Act, as part of the Green Deal Industrial Plan, is currently under deliberation by the European Parliament and the Council of the EU. Both initiatives are meant to address the EU’s dependency on imported critical raw materials by diversifying and securing a domestic and sustainable supply of critical raw materials. This would be achieved by funding projects that aim to scale up the EU manufacture of key carbon neutral or ‘net-zero’ technologies to ensure a secure, sustainable and competitive supply chain for clean energy. The scope of projects funded cover mineral exploration activities and the identification and designation of strategic projects for critical raw materials[43].

The European Commission also now publishes an updated list of EU Critical Raw Materials every three years.

The European Battery Alliance

The European Battery Alliance (EBA) was launched in 2017 by the European Commission. It entails industry players from Europe actively collaborating with research institutes, public bodies, national authorities and the European Investment Bank to build and sustain a complete domestic battery cell manufacturing value chain.

The EBA developed the Strategic Action Plan on Batteries in 2019, which sets out a comprehensive framework of regulatory and non-regulatory measures to support all segments of the battery value chain. These measures include:

- securing access to raw materials

- supporting European battery cells manufacturing at scale and a full competitive value chain in Europe

- strengthening industrial leadership through stepped-up EU research and innovation to advanced and disruptive technologies in the batteries sector

- developing and strengthening a highly skilled workforce

- supporting the sustainability of EU battery cell manufacturing industry, and

- ensuring consistency with the broader enabling and regulatory framework in support of batteries and storage deployment.

In January 2024, EIT InnoEnergy (the innovation engine for sustainable energy supported by the European Institute of Innovation & Technology which is a body of the European Union) and Demeter Investment Managers (a major European private equity and venture capital firm) launched the Strategic Battery Materials Fund with the primary goal to invest in early-stage upstream projects focused on the mining and recycling of critical minerals including lithium, nickel, cobalt, manganese and cobalt[44].

At least 70% of investments from the EBA Materials Fund will be dedicated to projects increasing EU domestic production from mining, processing, refining and recycling in EU and neighbouring countries. The remaining 30% will focus on increasing raw material supply from EU Raw Material Partnership countries, such as Canada, Namibia and Argentina.

Subsidiary investigations into Chinese-made EVs

In protecting the car manufacturing and EV-related sectors, the European Commission is currently investigating Chinese EV imports into the EU for suspected breach of EU competition rules – the EU’s suspicion being that Chinese EV companies are benefitting from significant state subsidies derived from the country’s trade and industrial policies to sell their EVs at an unfairly low price in the EU hence distorting the EU market[45]. The EU probe is expected to conclude in the second half of 2024.

Less than a month after the US announced plans to increase tariffs on Chinese EV imports from 25% to 100, the European Commission in June 2024 announced it would combat the aforementioned excessive subsidies with additional tariffs of up to 38.1%[45] on imported Chinese EV to take effect from 5 July this year. Both sides are currently in talks to resolve this dispute…

Notwithstanding the above developments, Chinese automakers appear undeterred. BYD and Geely-owned Volvo announced new investments in EV production in Europe to shift closer to final demand. Unlike in the US, where Chinese EV investment has been heavily scrutinized, EU member states have so far been eager to receive Chinese EV investment. In fact, EU member states are competing against each other to offer incentives to Chinese firms.

The EU is faced with a potential dilemma of its own making. One of its stated goals is to completely phase out the internal combustion engine in favour of EVs by 2035, supported by rapidly increasing mandatory EV sales quotas. The availability of cheaper Chinese EVs is arguably an important factor in the viability of these targets. The potential adverse impact would be greater again if we assume that tariffs would apply equally to western automakers importing Chinese-made EVs into Europe.

Efforts by other countries to build sustainable supply chains

Other countries are ramping up their strategies for identifying and securing a sustainable supply of critical minerals.

- The United Kingdom (UK) published its Critical Minerals Strategy in July 2022 and its Critical Minerals Refresh on 13 March 2023.

- The UK is considering whether to launch a similar investigation into Chinese-made EVs to that running in the EU. This is because Chinese EVs are expected to be diverted into the UK market from the EU if the EU imposes tariffs on imports as a result of its investigation[46].

- Australia, Japan and Korea each maintain a list of critical minerals identified as essential for the country’s energy security.

The global shift: cooperation and innovation

Growing investment in domestic and in-house manufacturing

In addition to new and improved regulatory frameworks, governments and companies are investing heavily in expanding their domestic battery manufacturing capabilities.

Automakers worldwide have replicated the vertical integration model popular in China, in a shift from their previous business models, so as to control their supply chain margins and secure access to minerals supply.

- Upstream, Volkswagen and Stellantis have each invested US$100 million in mining company ACG’s efforts to acquire two mines in Brazil from private equity group Appian Capital. Volkswagen views its investment as a “prepayment for future nickel supplied by the mines”[49], primarily to bring down the cost of battery cells and meet the demand from its own operations.

- Downstream, Ford and General Motors are building battery plants.

- Tesla is breaking ground on its lithium refinery in Texas to produce its own battery-grade lithium (in turn reduce sourcing from China’s lithium refineries, responsible for producing the majority of refined lithium[50]).

As localisation grows for some nations, for others it’s a story of internationalisation

Companies in the EU and US are among those that have announced domestic plans for new mining, refining and cell production projects to help meet demand, such as the creation or expansion of battery factories. These companies are also exploring new business models for the recycling segment. By recycling raw materials primarily found in one location, companies and countries can reduce their dependency on others. Taken as a whole, these activities aim to increase the localisation of battery supply chains.

On the other hand, China’s EV companies are increasingly internationalising, expanding their manufacturing presence abroad, with most new investments planned in Europe, Brazil and Southeast Asia. Chinese battery manufacturers are bringing more of the supply chain with them in their overseas expansion, likely in response to growing market demand and re-shoring pressures.

Some countries have proactively tried to attract investment, with China manufacturers the key target of Thailand’s goal to lure US$28 billion of foreign investment by 2027[51]. Chinese companies have responded in kind to Thailand’s suite of tax incentives and subsidies, committing to invest US$1.44 billion in new production facilities and the establishment of the China Automotive Technology and Research Centre in the country[52].

Global cooperation diversifying supply chains and driving innovation

Though we see reasonably strong themes of protecting national interests, there are also examples of strategic partnerships used to mitigate risks in the rebalancing and development of supply chains.

- Multi-country effort to build supply chains

One example is the Minerals Security Partnership (MSP). The MSP is an ambitious new US-led partnership to accelerate the development of diverse and sustainable critical energy minerals supply chains. Comprising of 15 states including Australia, Canada, Korea, the UK and the US, it aims to do this by collaboration between host governments and industry to facilitate targeted financial and diplomatic support for strategic projects. The MSP considers projects along the full clean energy value chain. A recent statement confirmed that 23 undisclosed projects covering mining, extraction, and secondary recovery, to processing and refining, then finally recycling, are in motion[53]. Although this global initiative is a step in the right direction to secure a stable supply these critical minerals, it cannot eliminate the supply chain vulnerabilities that members of the MSP are facing. Certain critical minerals are not found in extractable quantities within the member countries[54], and so a dependence on China or other third countries will still exist.

- Trade deals to secure critical minerals, products and components

Countries are considering new avenues for procurement of critical minerals (or products and components developed from them later in the supply chain). So far, the US has made just one critical minerals trade deal, with Japan in 2023 (the US-Japan Critical Minerals Agreement), allowing Japanese companies to leverage US tax incentives as they supply EV battery materials[55], a positive development from this agreement being Mitsubishi Chemical’s plans to establish a new production base for anode materials in the US with an annual capacity of 10,000 tonnes (enough material for 100,000 EVs)[56]. The US is also in talks with the UK, the EU and nickel-rich Indonesia, but these talks are in the preliminary stages and will take time.

https://www.innoenergy.com/news-events/eit-innoenergy-and-demeter-launch-e500m-european-battery-raw-materials-fund/ and https://www.reuters.com/business/energy/eu-backed-investors-plan-500-mln-euro-battery-raw-materials-fund-2024-01-18/

As it stands, Chinese EV maker BYD will face tariffs of 17.4 per cent, Geely 20 percent, and SAIC 38.1 percent. This comes on top of an existing general tariff of 10 per cent for imported EVs, meaning SAIC vehicles will be a total of 48.1 per cent more expensive to bring into the European market: https://www.theparliamentmagazine.eu/news/article/interview-political-china-ev-tariffs-will-be-hard-to-undo

In the case of the rare earth element dysprosium, used in lighting and lasers, China is responsible for 84% of mined supply and 100% of refined supply.

Norwegian anode startup Vianode is considering building its first large-scale synthetic graphite plant in US rather than Europe due to the subsidies available under the IRA, the plant will have the capacity to produce around 50,000 tonnes of synthetic graphite a year, for more information: https://source.benchmarkminerals.com/article/the-inflation-reduction-act-has-really-shifted-the-whole-battery-industry-towards-north-america-qa-with-vianode-ceo-hans-erik-vatne. New synthetic graphite production operations in the US, including Anovion’s $800 million plant in Bainbridge, Georgia, and Novonix’s $160 million plant in Chattanooga, Tennessee, will benefit from US incentives included in the IRA and the bipartisan Infrastructure Investment and Jobs Act: https://www.mining.com/web/synthetic-graphite-for-ev-batteries-can-the-west-crack-chinas-code/.

US Geological Survey, “Mineral Commodity Summaries” published in January 2023: https://pubs.usgs.gov/periodicals/mcs2023/mcs2023-graphite.pdf

Responding at least in part to China’s recent ban on the export of graphite, efforts are being made to support the development of synthetic graphite in the US and Europe[57]. It is possible that this new form of graphite could account for up to two-thirds of the EV battery anode market by 2025[58]. Alternative sources of mined graphite are also being considered, an example being Quebec, Canada which is seeing interest among many exploration and development companies due to factors including its geographical feasibility[59]. Africa has also been a recent focus for graphite exploration, with projects under development in Madagascar, Mozambique, Namibia, and Tanzania[60].

- US encourages efforts in Australia

The members of the MSP further co-operate amongst themselves. The US has recently designated Australia as a domestic source under the Defense Production Act, allowing Australia to benefit from the Inflation Reduction Act’s clean energy incentives. On that basis, Australian-based businesses will be eligible to receive loans, grants and purchasing contracts direct from the US Government to support priority sectors, such as critical minerals supply chains and advanced capabilities[61].

- Japan and Canada cooperate on supplies

Following Korea’s lead, in response to China’s new restrictions on graphite exports, Japan has been looking to Canada and Africa for EV and chip materials. In return for financial, scientific and technical help, the Canadian government is subsidising new Japanese investments to develop Japan’s own EV battery supply chain. Japan has further announced plans to work with several African countries including Namibia and Angola on joint mineral development and support the entry of Japanese companies into African nations to secure important mineral resources[62].

- Companies collaborate to share knowledge

We see these collaborative endeavours fostered not just on a national level but between EV companies as well. And, consistent with some of the examples of encouraging Chinese foreign investment, partnership and knowledge sharing already mentioned, some of this collaboration is occurring across what might be regarded as geopolitical lines.

In July 2023, Volkswagen entered a technology partnership with Xpeng Motors to release two EVs in China.

More recently, Tesla partnered with Baidu to use Baidu’s mapping and navigation function for Tesla car’s self-driving feature on Chinese roads.

The China Plus One Strategy: Growing industries in low-cost economies – including across Southeast Asia

China Plus One (or China+1) is a business strategy to channel investments into manufacturing in other promising developing economies such as India, Thailand and Vietnam.

When this strategy first emerged, the goal was to move manufacturing and production to lower-cost developing countries to reduce expenditure. In more recent years, the strategy has also been about securing diversification of supply chains. To benefit from the IRA, a potential supply chain restructuring plan under evaluation is to source raw materials from South America and Australia, ship them to Mexico or Canada to be processed and finally assemble the EV batteries and EVs in the US[63].

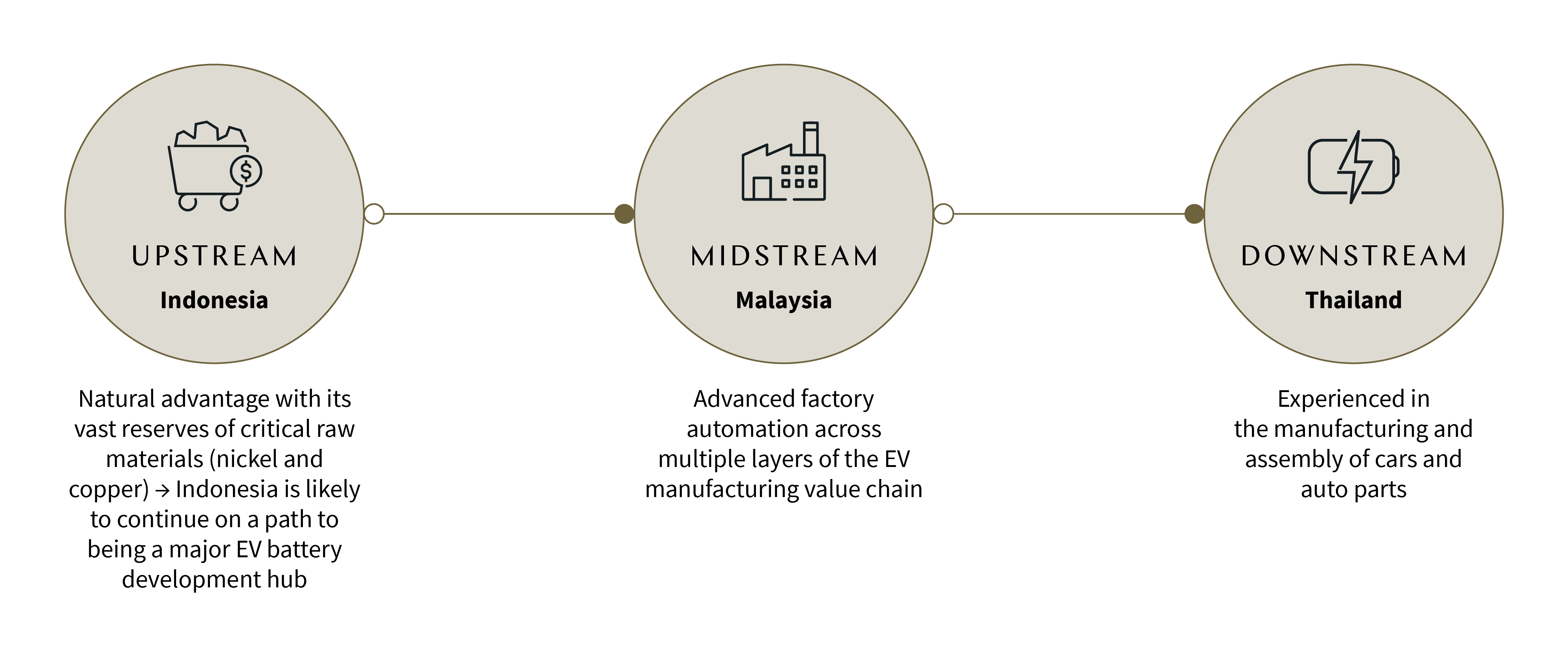

How we predict this strategy to play out in the EV industry here in Southeast Asia[64]:

Thailand is Southeast Asia's largest car producer and exporter, and its second-largest sales market after Indonesia. The Chinese wave is already beginning to reshape Thailand's auto industry, as EV makers from China bring in their suppliers and local Thai firms seek new partnerships. China surpassed Japan as Thailand's top foreign investor last year, boosted by BYD's investment in a new plant set to start up in 2024, amid concerted efforts by Thai officials to draw Chinese EV producers. For further information: https://www.reuters.com/business/autos-transportation/china-led-ev-boom-thailand-threatens-japans-grip-key-market-2023-07-09/

Chinese companies have refined this strategy. The aim is to build business ties with new regions by transferring parts of the company’s industrial supply chain and, in the process, diversify and build resource bases to eventually enter new markets in those regions.

Apart from Congo where Chinese companies procure a majority of their cobalt supply, there has been a recent billion-dollar wave of Chinese lithium deals in Africa where many Western investors have not yet fully ventured into[65]. Zhejiang Huayou Cobalt Co. bought a lithium mine in Arcadia, Zimbabwe for US$422 million in 2021 and spent a further US$300 million to build Africa’s first Chinese-owned lithium concentrate plant. The plant has now started trial production in Arcadia and is expected to produce 50,000 tonnes of lithium carbonate equivalent lithium concentrate annually[66].

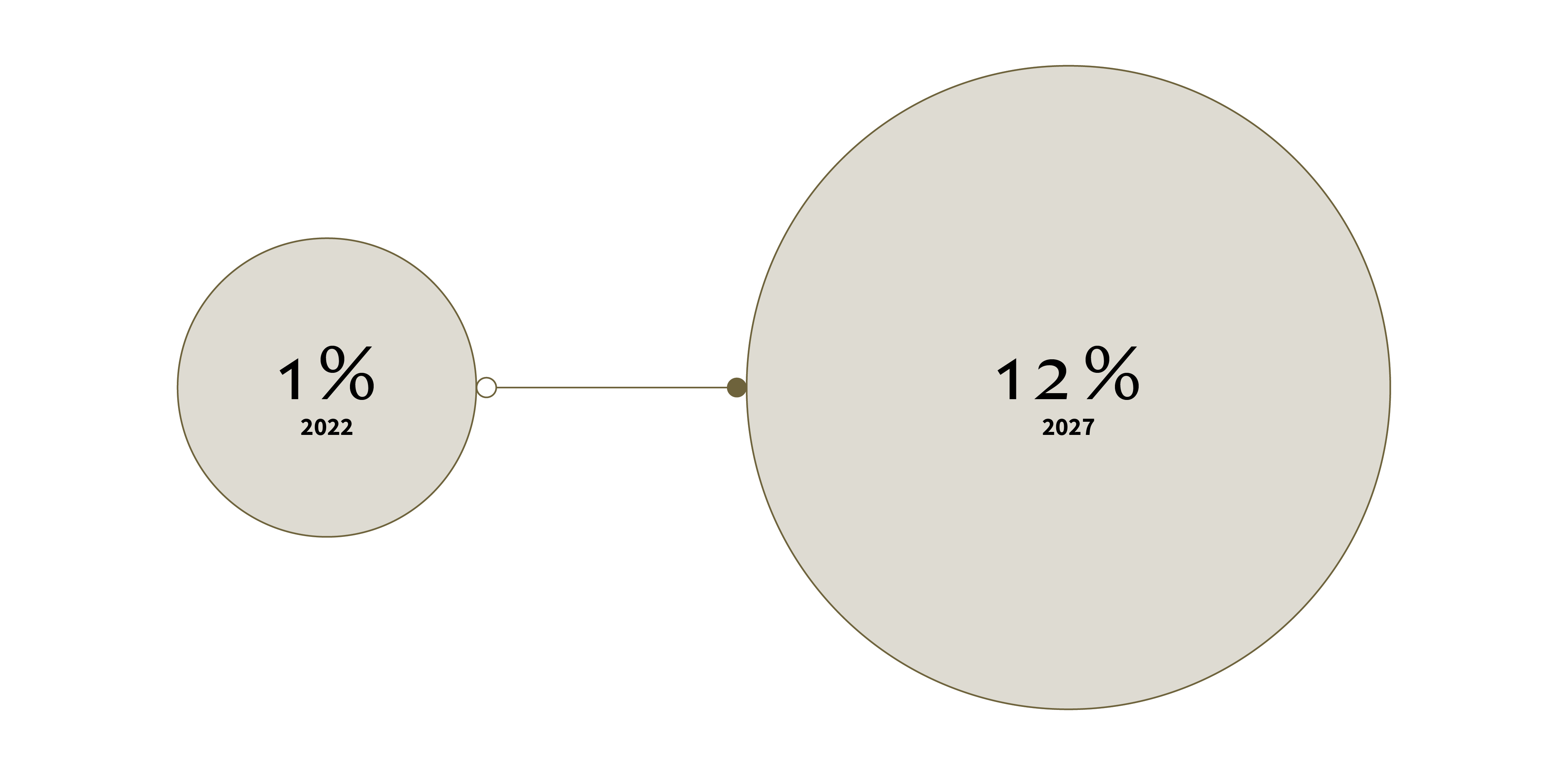

The early move to tap new sources of lithium supply across Africa has paid off[67] with mines across the continent forecasted to increase production of lithium raw material volumes more than 30-fold from 2023 to 2027. Africa will account for 12% of global supply by then, compared with 1% in 2022[68] and Chinese positions in the market have positioned it to continue as the world’s leading lithium refiner with control over a significant portion of the lithium supply chain.

Africa’s projected rapid increase in global lithium supply

Conclusion: Establishing a truly global EV battery supply chain

In the quest for clean energy in transportation, EV batteries are pivotal. Securing their supply chains is critical, especially given the global EV market's explosive growth. The current prominence of Chinese companies in the EV battery supply chain is undeniable. The benefits brought by Chinese companies in EV and battery technology sectors are also difficult to deny, given their advancements in EV and battery technology, and overall scale of their operations in these sectors.

Equally, certain players have actively pursued a diversification strategy to ensure a more inclusive global effort. While recognising the different (and possibly competing) concerns, it is ideal for stakeholders (countries and commercial entities alike) to align their foreign and domestic economic interests with international climate commitments to propel the clean energy transition effectively.

Though the goal is ambitious, advancing towards net-zero emissions is a challenging journey and one which is a truly global effort, where EV and related battery technologies have the potential to play a crucial role.

Key takeaways for businesses

- Diversify supply chains and audit vulnerabilities: Reduce reliance on single sources, particularly for critical raw materials like lithium, cobalt, manganese, nickel and graphite.

- Reassess manufacturing locations: Consider the feasibility of manufacturing in alternative locations that offer cost advantages or strategic benefits.

- Explore recycling opportunities: Investigate recycling raw materials from used batteries to reduce dependency on raw material imports and support sustainability.

- Monitor regulatory changes and trade agreements: Stay abreast of regulatory shifts towards sustainability and be prepared to adapt to new policies, such as bans on ICE vehicles and incentives for EV adoption, as well as international trade agreements.

- Form strategic partnerships: Consider forming strategic partnerships to mitigate risks and ensure a stable supply of critical materials.

- Seek government support: Explore opportunities for financial support from government initiatives aimed at boosting domestic EV battery production.

For more on the energy transition, subscribe to our ESG updates and see: