On 12 October 2023, the Task Force on Climate-related Financial Disclosures (TCFD) published its sixth and final status report. The TCFD will now be disbanded as its work has come to a close and the International Sustainability Standards Board (ISSB) will monitor progress on the state of climate-related financial disclosures by companies as of next year.

However, as one task force ends, another, the Taskforce on Nature-related Financial Disclosures (TNFD), is gaining momentum. On 18 September 2023, the TNFD published its final framework for market adoption.

The TNFD framework marks an important first step towards mandatory nature-related reporting in Australia. It aligns with Target 15 of the Kunming-Montreal Global Biodiversity Framework (GBF) (which calls on businesses to monitor and transparently disclose their risks, dependencies and impacts on biodiversity), and is relevant to the broader GBF targets to restore and conserve 30% of land and waters by 2030. Parties to the Convention on Biological Diversity (including Australia) adopted the GBF in December 2022, around the same time the Australian Government released its ‘Nature Positive Plan’ which is the roadmap for Australian environmental law reform and includes the establishment of a ‘Nature Repair Market’.

Target 15 of the GBF is a 2030 target for parties to ‘take legal, administrative or policy measures to encourage and enable business, and in particular to ensure that large and transnational companies and financial institutions…regularly monitor, assess and transparently disclose their risks, dependencies and impacts on biodiversity, including with requirements for all large as well as transnational companies and financial institutions along their operations, supply and value chains, and portfolios…’

The TFND framework is a global, market-led, science-based and government-supported initiative designed to encourage early action to address nature loss and climate change. The framework is also intended to provide a structured path to increase ambition over time.

The framework is intended to complement existing standards like the Global Reporting Initiative to offer a path forward for organisations to better address nature-related risks.

The release of the framework marks the end of an extensive feedback and pilot testing loop which has led to the draft TNFD framework being viewed over 90,000 times by stakeholders in over 149 countries and territories since the release of its first beta version in March 2022.

Key features of the TNFD framework

The framework enables organisations to conduct a holistic assessment of their impact on nature through the inclusion of:

- key concepts and definitions to help a wide range of market participants understand nature, and nature-related risks and opportunities;

- a disclosure framework aligned with the approach and language used by the TCFD framework; and

- a dedicated risk and opportunity assessment approach (LEAP).

Key concepts and definitions

The TNFD expands the concepts under the TCFD framework to include dependencies of the organisation on nature, and impacts on nature caused, or contributed to, by the organisation.

It also highlights that nature-related impacts and dependencies, in contrast to climate-related issues, are location specific. According to the framework, understanding where interactions with nature occur is critical to identifying, assessing and managing nature-related issues.

Central to the framework is the idea that some locations are priority locations, either because the organisation has identified material nature-related dependencies, impacts, risks and opportunities in relation to them, or because they are sensitive locations (e.g. areas important for biodiversity, of high ecosystem integrity, of rapid decline in ecosystem integrity, of high physical water risk and/or that include benefits to Indigenous Peoples, Local Communities and stakeholders).

Disclosure framework

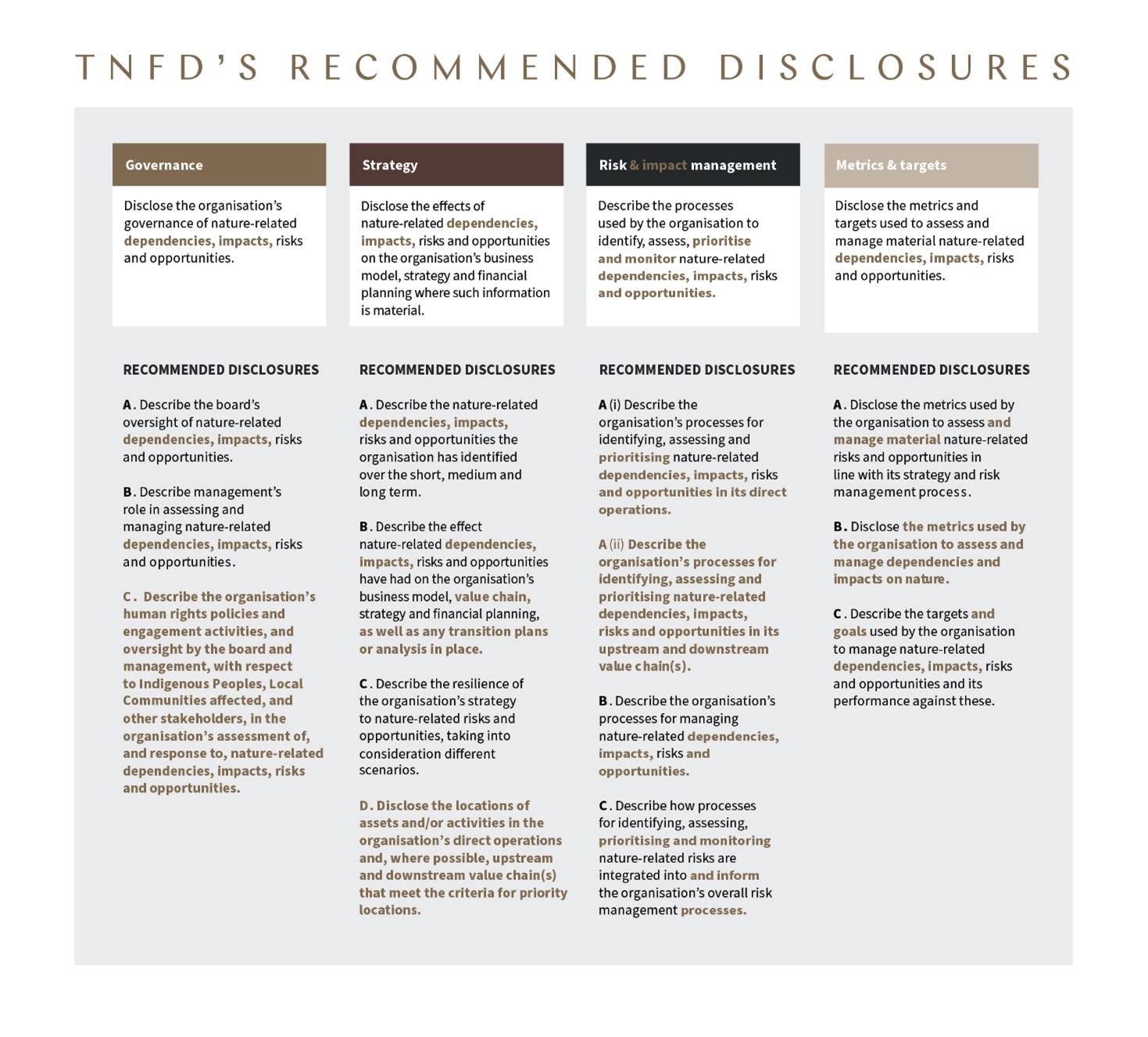

The disclosure framework is focused on the same four key pillars as the TCFD: governance, strategy, risk [and impact] management, and metrics and targets.

The full set of recommended disclosures is outlined below, with key differences to the TCFD disclosures highlighted:

Click to expand image

Source: modified from TNFD framework

LEAP

The LEAP assessment approach is a new addition to the TNFD framework that wasn’t in the TCFD framework.

Under LEAP, organisations are encouraged to:

- locate their business footprint (direct assets and operations, related value chain activities) and how it interacts with nature;

- evaluate their dependencies and impacts at each of their “priority locations”, being locations where the organisation’s direct operations interface with nature in areas deemed to be ecologically sensitive or where the organisation has identified material nature-related dependencies, impacts, risks and opportunities;

- assess their material nature-related risks and opportunities; and

- prepare to respond and report in line with TNFD’s disclosure recommendations.

Does the TNFD framework affect me?

As we’ve written about in our latest report on climate-related disclosure and governance trends of the ASX50 in 2022, some ASX50 entities are already piloting the TNFD framework. Additionally, at the time of the report, over half of ASX50 entities had already set nature-related targets. With the release of the TNFD framework, we expect stakeholder pressure on companies to report on nature-related issues, and to set nature-related targets, will only increase.

In considering the extent to which the TNFD framework may affect organisations, it is worth noting that a business’ footprint may be larger than the site on which the organisation operates, and include areas in which nature is subject to direct and indirect impacts that may be positive or negative, depending on the size of the activity.

The TNFD framework itself was developed in direct response to growing demand for an integrated nature-related risk management and disclosure framework to assist a wide audience of market participants, including investors, financial institutions, corporates and regulators.

Already, the TNFD has signalled that its priorities now that the recommendations have been published include:

- encouraging voluntary market adoption of the framework;

- engaging with government and regulators to implement nature-related corporate reporting in the GBF; and

- providing ongoing technical development of additional guidance to support market adoption.

What can I do?

Some proactive steps that you can take now in response to the release of the TNFD framework include:

- reading the framework and familiarising yourself with the final recommendations;

- piloting the framework in your organisation to assess your nature-related risks and dependencies and where opportunities for positive impact may exist;

- undertaking a gap analysis of TNFD and current reporting, and developing a plan to address any gaps including, where possible, leveraging nature-related data you already have in your organisation;

- reviewing any existing disclosures on nature to see if any updates are required to reflect the framework or any other developments (including the regulatory focus on greenwashing); and

- building capacity across your organisation in relation to nature, your strategy and governance approach to it and internal responsibilities.

What next?

The framework acknowledges the need for an iterative path to full adoption and we anticipate that the framework and our understanding of nature-related issues will continue to evolve over time based on market experience, advances in scientific knowledge and new technologies.

TNFD adoption may be faster, broader and deeper compared to TCFD adoption due to the extent to which the TNFD framework builds on existing frameworks – including the TCFD framework – as well as previous reporting and regulatory developments.

At King & Wood Mallesons, we recognise the significance of the TNFD framework and we are keen to continue to work with our client organisations to navigate this evolving landscape.