This alert was written by Paul Starr and Hana Doumal.

On 29 August 2019, the International Centre for Settlement of Investment Disputes ("ICSID") released an issue of its Caseload Statistics focused on the South and East Asia Pacific ("SEAP") Region.

This report is available here. We reproduce some charts of this issue below with copyright acknowledgement to ICSID.

Multilateral Investment Treaties ("MITs"), such as the Association of Southeast Asian Nations Agreement for the Promotion and Protection of Investments (the "ASEAN Agreement") and the Energy Charter Treaty (the "ECT"), and Bilateral Investment Treaties ("BITs") provide an alternative to the commercial arbitration mechanism that may be prescribed in investment contracts. Indeed, in investment treaties, arbitration is a right conferred upon a qualifying investor by a BIT or MIT between the State of the qualifying investor and the host State where the investment has been made.

ICSID, established in 1966 by the Convention on the Settlement of Investment Disputes between States and Nationals of Other States (the "ICSID Convention"), is the world's leading institution administering investor-State cases, with ICSID arbitration being the usual dispute resolution mechanism in MITs and BITs (for example, in China Mainland BITs).

This report focuses on cases involving SEAP States (which represent 53 cases of the 728 registered ICSID cases until 30 June 2019, i.e., 7%) as well as cases involving investors from SEAP States (5% of those 728 cases) as a party to an ICSID arbitration.

The SEAP States involved as a party to an ICSID case are: Indonesia, Pakistan, Bangladesh, the Philippines, Sri Lanka, China Mainland, the Republic of Korea, Malaysia, Papua New Guinea, Lao PDR, Cambodia, Mongolia, Nepal, New Zealand, Timor-Leste and Vietnam.

For each category, the report contains data on:

- the type of case (i.e., registered under the ICSID Convention or the Additional Facility Rules);

- the basis of consent (BIT, investment contract, investment law of the host State, ECT, ASEAN Agreement, etc.);

- the economic sector (oil, gas & mining, electric power & other energy, transportation, construction, finance, etc.);

- the nationality and type of investor (juridical or natural person);

- the outcome (dispute decided by the Tribunal or settled or proceeding otherwise discontinued) and findings in such cases (declining jurisdiction, upholding claims in part or in full, dismissing all claims or deciding that the claims are manifestly without legal merit).

Type of case

50 out of the 53 cases involving SEAP States as a party to an ICSID arbitration were initiated under the ICSID Convention, and only 3 cases were commenced under the Additional Facility Rules (i.e., cases where the State is not a Member State of the ICSID Convention or cases where the investor is a national of a State which is not a Member State of the ICSID Convention).

Moreover, 97% of the cases involving investors from SEAP States were commenced under the ICSID Convention, and only 3% were initiated under the Additional Facility Rules.

Basis of consent

64% of the cases involving SEAP States as a party to an ICSID arbitration are based on a BIT; 29% on investment contracts; 3% on the host State's consent in an investment law; 2% on the ASEAN Agreement and 2% on the ECT.

42% of the cases involving investors from SEAP States as a party to an ICSID arbitration are based on a BIT; 35% on investment contracts; 10% on the host State's consent in an investment law; 3% on the ASEAN Agreement, 7% on the ECT, and 3% on the Peru-Singapore Free Trade Agreement.

Economic sector

Out of the 7% of ICSID cases involving SEAP States as a party to an ICSID arbitration: 36% are oil, gas & mining disputes; 13% are electric power & other energy disputes; 7.5% are transportation disputes; 7.5% are construction disputes; 7.5% are financial disputes; 7.5% are services & trade disputes; 9% of cases involve other industries; and the remaining 12% are disputes involving the following sectors: agriculture, fishing & forestry, tourism, information & communication, and water, sanitation & flood protection.

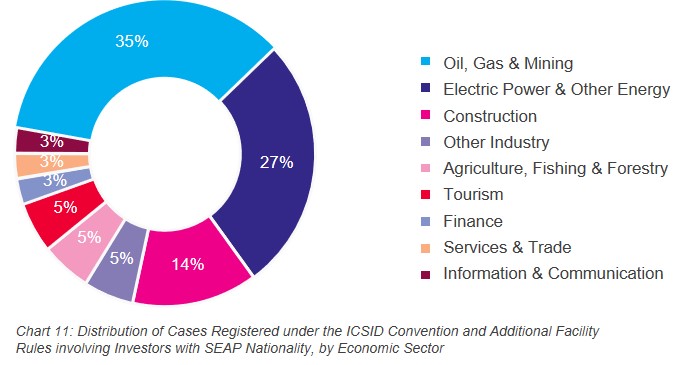

Out of the 5% of ICSID cases involving investors from SEAP States: 35% are oil, gas & mining disputes; 27% are electric power & other energy disputes; 14% are construction disputes; 3% are financial disputes; 3% are services & trade disputes; 5% of cases involve other industries; and the remaining 13% are disputes involving the following sectors: agriculture, fishing & forestry, tourism, and information & communication.

Investor

In the 53 cases involving SEAP States as a party to an ICSID arbitration: 20 involved investors who are nationals of a SEAP State and 33 involved investors from States outside of the SEAP Region; 9% of the investors are natural persons (i.e., individuals) and 91% are juridical persons, either small, medium or large enterprises (corporations, partnerships and joint ventures).

Outcome and findings

57% of the concluded ICSID cases involving SEAP States as a party to an ICSID arbitration were resolved by a final award of an ICSID arbitral tribunal: 44% of which declined jurisdiction; 30% upheld the claims in part or in full; 22% dismissed all claims and 4% decided that the claims were manifestly without legal merit. The other 43% of those 53 cases were settled by the parties (18%), discontinued at the request of both parties (41%) or of one party (41%) before a final determination of the arbitral tribunal.

52% of the concluded ICSID cases involving investors from SEAP States were resolved by a final award of an ICSID arbitral tribunal: 33% of which declined jurisdiction; 42% upheld the claims in part or in full; 17% dismissed all claims and 8% decided that the claims were manifestly without legal merit. The other 48% of those cases were settled by the parties (18%), discontinued at the request of both parties (46%) or of one party (27%) before a final determination of the arbitral tribunal, or discontinued for lack of payment of the required advances (9%).

Appointments

This report also includes a breakdown of appointments of nationals from the SEAP Region as arbitrators, conciliators and ad hoc committee members in ICSID cases, and only 11% are nationals from the SEAP Region: most of them appointed by the parties and only 5% of those SEAP nationals being women.

The number of appointments of SEAP nationals should (hopefully) increase significantly with the recent and active promotion of diversity in international arbitration (68% of the ICSID arbitrators are from Western Europe or North America), and we should also see more appointments of women in ICSID tribunals and in arbitral tribunals in general!

With the Belt & Road Initiative (BRI), the multiplication of disputes with SEAP States or investors from the SEAP Region will also continue to increase in the years to come, and so will the number of ICSID arbitrations.

For further details on BRI disputes, see our Practical Guide: How to resolve disputes on the Belt and Road, available here.