Authors: Richard Mazzochi, Minny Siu, Stanley Zhou, Stella Wang and David Mu

On 5 May 2020, the People's Bank of China ("PBOC") and the State Administration of Foreign Exchange ("SAFE") issued the Regulations on Fund Administration for Domestic Securities and Futures Investments by Foreign Institutional Investors ("New Regulation", as supplemented with the FAQs published by SAFE[1]), introducing the latest round of reforms to the QFII and RQFII schemes – China's two major inbound investment systems. The New Regulation will take effect on 6 June 2020.

This article summarises what you need to know about the QFII and RQFII regimes, the key changes under the New Regulation, and what they mean for overseas institutions.

PRIOR to the New Regulation: what are the existing features of the QFII and RQFII regimes?

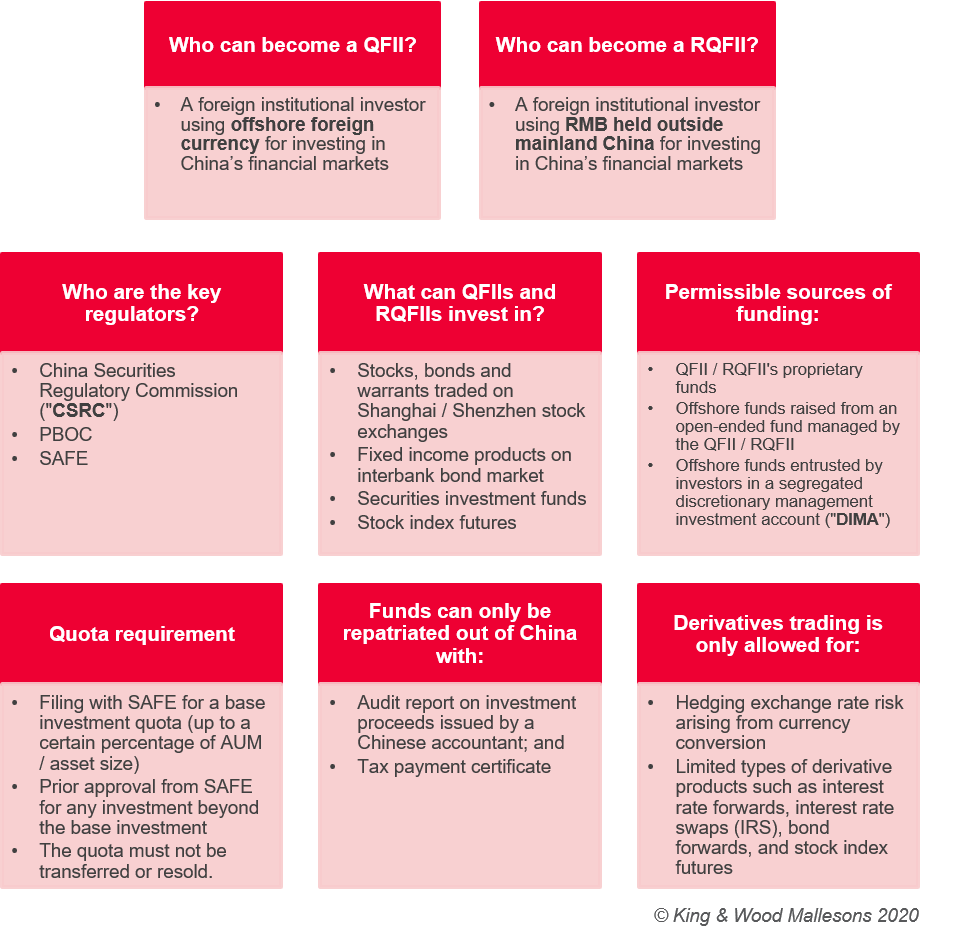

The QFII and RQFII schemes were introduced in 2002 and 2011 respectively to encourage foreign participation in its financial markets. Below is a snapshot of the key features of the two schemes prior to the introduction of the New Regulation:

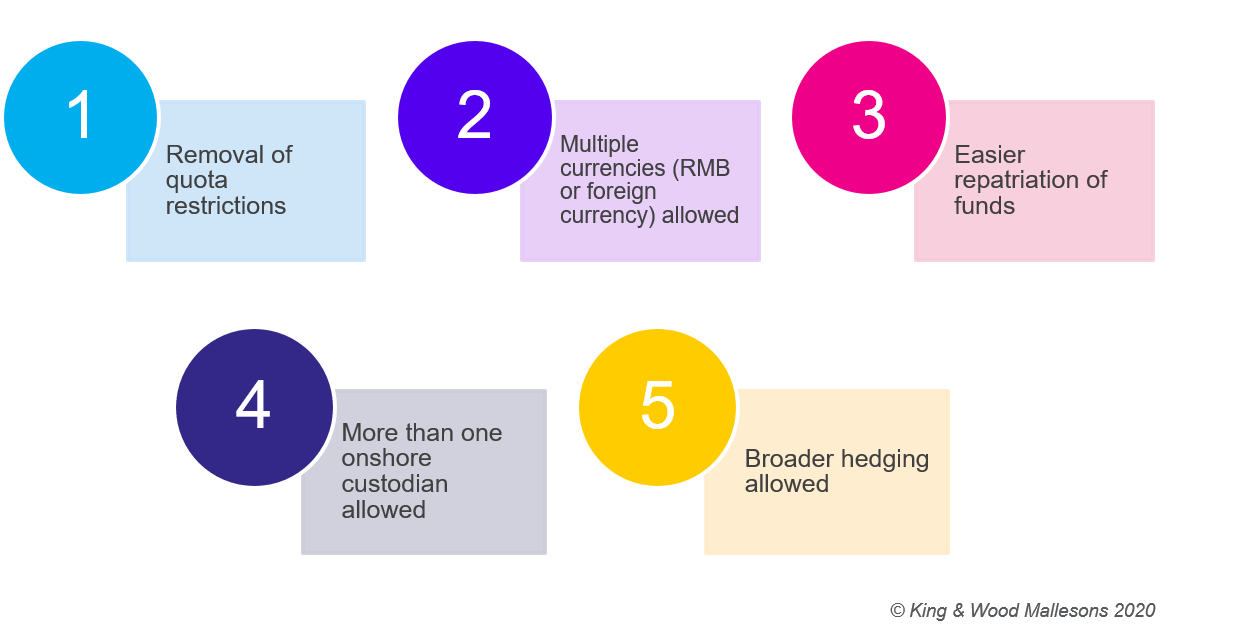

Key changes under the New Regulation starting in June 2020

The New Regulation introduces a number of key changes:

Key changes |

Description |

Removal of quota restrictions |

There is a long-standing policy restriction against quota transfer or sale by a QFII/RQFII to a third party. The New Regulation is silent on this issue. Notwithstanding the removal of quota restriction, we believe QFIIs/ RQFIIs should retain control over its investment decision under its license, and not to offer non-discretionary investment management services for its clients using the QFII/ RQFII channel. |

Multiple currencies allowed |

|

Easier and streamlined repatriation of funds |

The streamlined and simplified fund repatriation requirements should substantially speed up the process of remitting investment proceeds by QFIIs/ RQFIIs. |

More than one onshore custodian allowed |

|

Broader hedging allowed |

|

Implications

- The New Regulation follows the launch of a number of new channels for foreign investors to participate in China's financial markets without quota limits (including the Stock Connect and Bond Connect) and a series of opening-up policies in futures, securities and mutual fund sectors in China.

- This development furthers China's policy of welcoming medium to long term overseas funds into the Chinese capital market.

- Offshore financial institutions and fund managers may take advantage of the lift in the investment quota and repatriation process to steadily increase their holdings of onshore assets, and better take advantage of the opportunities in the Chinese market.

What's next for QFIIs and RQFIIs?

- Down the track, it is anticipated that China's regulators will further expand the scope of permissible investments of QFIIs and RQFIIs to include private securities investment funds, shares traded on National Equities Exchange and Quotations, commodities futures and options, initial public offerings and secondary stock offerings. The relevant consultation is not yet finalised by the CSRC.

- For further details on this topic, please refer to our article dated 19 September 2019.

King & Wood Mallesons has dedicated teams advising on issues relating to the QFII / RQFII schemes, applications for QFII/RQFII status, appointment of custodians, cash repatriation, offshore fund-raising structures (including DIMA) and complex cross-border transactions involving QFII/RQFII assets. We look forward to working with our clients on these exciting projects. Please speak to us if you have any questions.

[1] The FAQs for the New Regulation can be accessed at http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4019498/index.html

[2] Under the current rules, QFIIs /RQFIIs are permitted to use interest rate forwards, interest rate swaps (IRS) and bond forwards, as well as stock index futures for hedging purposes.