The province of Hainan is sometimes referred to as the Hawaiʻi of China: a place of tropical weather, rainforests, beach resorts and luxury shops. A marine mecca for tourists, surfers and golfers alike.

It is the island home of some of the world’s longest-living people and Wenchang chicken, a dish popular in mainland China and across south-east Asia.

Hainan is also the potential future home of an international carbon trading exchange market linking China’s new national emissions trading scheme (ETS) with the world.

China’s national ETS launched in July 2021 after years of planning. Foreign investors do not currently have direct access, but this will change.

The Hainan provincial government wants to be a critical player in this scene; proposing an international carbon trading exchange as part of efforts to transform the island into a bustling globally recognised free trade port.

Sitting at the southern-most tip of China, Hainan translates literally as “south of the sea”.

The tropical island is separated from the Guangdong province by a narrow body of water. The Qiongzhou Strait (or colloquially, the easier-to-remember Hainan Strait) is 30 kilometres wide on average – half the distance of a trip from downtown Beijing to the nearest section of the Great Wall of China, or a trip halfway around the perimeter of Manhattan in New York City.

China’s holiday destination not only evokes the US state of Hawaiʻi but counts it among 32 “sister cities”. Both have a strong environmentally-conscious undercurrent: green sea turtles are protected by law in Hawaiʻi; while a not-for-profit works to conserve the shell-backed creatures in Hainan.

Hawaiʻi became the first state in the US to declare a climate emergency this year and is seeking to reach 100% renewable energy by 2045 as a member of the US Climate Alliance States. Hainan is among major cities and provinces with emissions peaks set in their five-year plans, aligning with China’s national plan.

Last year, China gave the province “free trade port” status, aiming to turn it into an offshore trade and finance centre and growth hub for high-tech industries and tourism. Policies include opening the flow of trade and investment by 2025 and data and capital by 2035.

Hainan has released its own plans to meet the objective, including financial reform and green finance innovation, opening the financial industry, encouraging “free and convenient” cross-border capital flows and enabling safe data transfers.

It is a dramatic facelift for an island which became a province in it own right in 1988, separating from Guangdong province and blossoming as a modern tourist centre.

For many beyond China, Hainan might trigger thoughts of a world-renowned rice dish bearing its name: Hainanese chicken. Hainanese chicken, however, is in fact a national dish of nearby Singapore. A century ago, Hainan sailors took a local recipe abroad, fusing it with Singapore’s cuisine.

The predecessor dish exported all those years ago remains popular in the province today: Wenchang chicken. Named for a city in Hainan’s northeast, Wenchang chicken requires the use of free-range chickens; not because it is trendy but because locally roaming poultry is essential to the traditional recipe for its superior taste and texture.

The dish is so well-known it contributes to a saying: “It’s not a party without Wenchang chicken”.

Another trading hub across the Hainan Strait may get there first: the Greater Bay Area (GBA).

The GBA links Hong Kong, Macao and nine cities in the south-eastern province of Guangdong. China’s plan to build the GBA into a world-class epicentre of economic activity and innovation includes an online carbon trading platform attracting investments via Renminbi and foreign currency.

This would utilise Guangzhou’s existing ETS’s platform. It may take five years to crystallise, but we are closely tracking progress to ensure our clients are ready for access via the thriving GBA, or even, eventually, Hainan or the central trading platform in Shanghai.

In the meantime, foreign investors can participate in regional schemes in Hubei, Guangdong, Shenzhen and Fujian.

Why China’s new ETS matters – and you should take note

China’s ETS became the world’s 64th carbon pricing mechanism when it launched in February 2021, before going live on the Shanghai trading platform on July 16, 2021.

Opening at a price of ¥48 ($USD7.41) per tonne on the Shanghai Environment and Energy Exchange, some 4.1 million tonnes were traded that day. Volumes traded and price levels have since ebbed. Just 658 tonnes traded in one week in September.

As of late October, the total trading volume was ¥800million (approximately US$124million), dwarfed by the EU trading volume. Yet trading has since passed the ¥1 billion mark and there are key reasons why it is a market worth watching.

For one, the sheer size of the scheme. China’s national ETS is not only the world’s newest: it is also the biggest by emissions coverage. Each of the 2,225 thermal power plants covered emitted at least 26,000 tonnes of carbon dioxide in one (or more) of the years between 2013 and 2019; collectively, around 40% of China’s emissions. Over time the scheme will expand to cover more sectors: petrochemical, chemical, building materials, steel, nonferrous metals, paper, and domestic aviation.

Two, foreign investors are expected to get access over time, as detailed above.

Three, and possibly most importantly, it brings a timely boost to the global paradigm shift as businesses and governments commit to ambitious net zero goals. Some $US90 trillion infrastructure investment is needed in the next decade.

One of the most significant outcomes of the Glasgow COP26 was the joint declaration between the US and China recognising the “seriousness and urgency of the climate crisis” and commitment to “accelerated actions in the critical decade of the 2020s, as well as through cooperation”. On the flipside, one of the last minute concessions in Glasgow was to allow countries to use ‘old’ carbon credits towards their emissions reduction targets. The quality of such credits and how far they actually align with current thinking as regards climate change mitigation is questionable.

Amid the growing wave of governments around the world setting targets for reaching net zero emissions, no pledge is as significant as China’s.” – International Energy Agency

Nonetheless, the International Energy Agency predicts China will beat its target of carbon neutrality by 2060, reaching ‘peak’ emissions within the next five years.

China’s 5-year plan is the most important element of its social and economic development, setting a mandatory total emissions reduction of 18% and reduction in energy intensity of 13.5% by 2025.

Already the leading exporter of clean energy technology to the developing world and the largest producer of electric cars, buses and batteries, China is pitching its place as a leader in hydrogen – one of six future industries featured in the nation’s 5-year plan – and a hub for sustainable financing.

The national ETS will accelerate the global drive to reach net zero, pushing businesses to slash emissions and sending investors surging towards sustainable lending and impact investing.

What you should know about China’s ETS

1. China has done this before

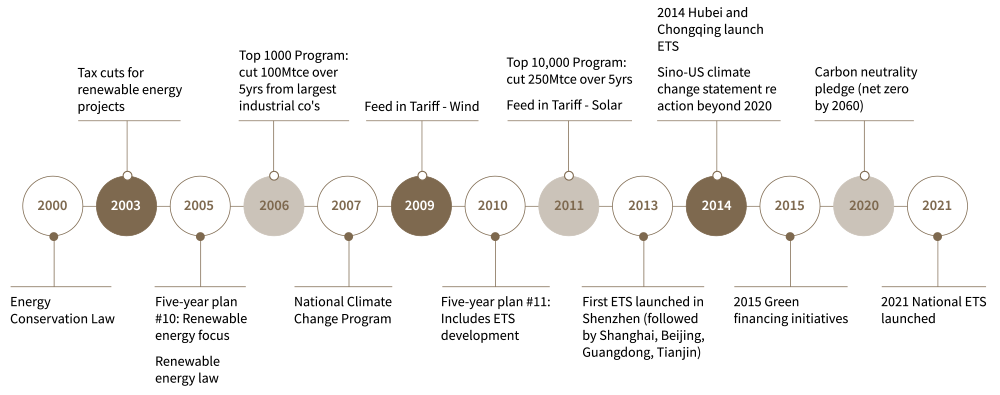

This is not China’s first foray into carbon trading. Eight regional pilot schemes were introduced across 2013 (in Beijing, Shanghai, Shenzhen, Tianjin, and the Guangdong province), 2014 (the Hubei province, and Chongqing), and 2016 (Fujian province). Sectors covered and prices vary. In Beijing, manufacturers and domestic aviation are among those covered with prices in the $US12-14 range; in Hubei, any power or industrial entity breaching a threshold is captured with prices around $US3-5.

We expect the regional schemes will gradually phase out as the national scheme expands to capture more sectors. Entities covered by the national scheme have already made the transition.

The national ETS operates via two of those regional centres: a centralised trading platform in Shanghai (the Shanghai Environment and Energy Exchange) and a national registration and clearing platform in Hubei Province.

The Shanghai Environment and Energy Exchange is going to become very important – remember that name.” – Gu Jieyu, KWM Partner

Local institutions and professional investors can participate but eligibility criteria are uncertain.

China also has a voluntary carbon reduction program, providing eligible projects with offset credits (China Certified Emissions Reduction, or CCER; new credits were suspended in 2017 but existing ones are still traded on regional platforms). In its initial phase the national ETS is restricted to allocations made within the scheme, but the intention is to allow entities to offset up to 5% of verified emissions by surrendering those voluntary CCER credits.

There are also plans to form a carbon emissions future market, centred on the Guangzhou Futures Exchange. Initiatives such as the Wealth Management Connect scheme and the international launch of e-CNY, China’s central bank digital currency will also enable cross-border investment with favourable foreign currencies (critically, that means no cryptocurrencies).

2. Credits are given at the entity level – not over the sector or market

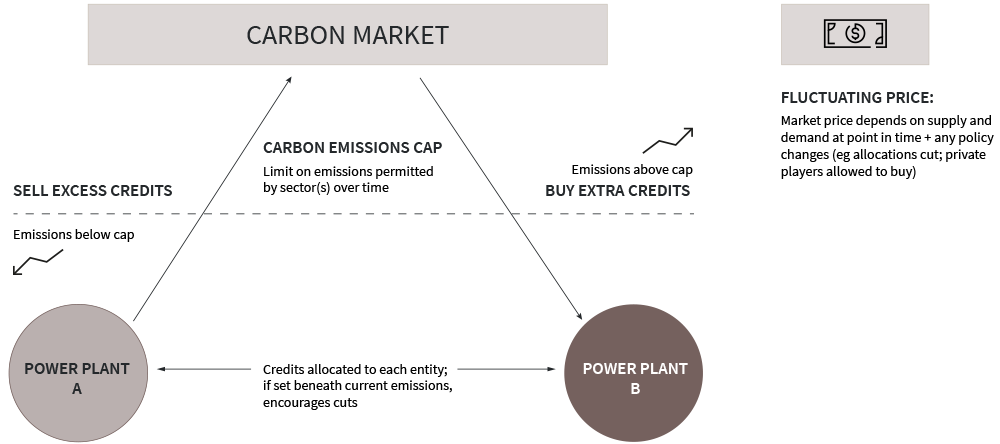

In a carbon market the commodity passing hands is a credit (or ‘allowance’), each carrying permission to emit one metric tonne of carbon. A cap is set on the emissions permitted by certain entities or sectors; those with a lower count can sell their excess while those who will exceed the limit must buy extra to make up the difference.

Most schemes – notably Europe’s – are “top-down”: a total allocation is set for an industry or a group of entities, which limits the amount available for all to purchase.

This year the EU’s cap on covered sectors (power plants, industry and manufacturing factories, aviation) is 1,571,583,007 tonnes of CO2. That means there are 1,571,583,007 ‘allowances’ available to purchase. The cap falls each year; from this year on by 2.2% (‘reduction rate’).

The roughly 10,000 covered entities must buy these ‘allowances’ to pollute. Some receive a portion for free (for example, the manufacturing industry received 80% of its allowances for free in 2013, but this has gradually dropped to 30%). The declining number of allowances each year is pushing up prices and therefore encouraging transformation and decarbonisation, especially as alternatives become cheaper.

China’s national ETS, by contrast, allocates credits at the entity level, set according to historic emissions levels.

3. The early aim is to improve energy efficiency – but rules will get tougher

Recognising China is still in a development phase and power demands are increasing, the scheme focuses on improving efficiency of existing plants rather than alternatives. Each power plant is given a free allocation of allowances based on 70% of their 2018 output multiplied by a benchmark factor which in turn depends on how much electricity it produces and the source of that energy.

There is also a unit load (output) adjustment factor which gives more allowances to entities operating at load rates lower than 85%.

The cap, then, is effectively the total of all allowances across entities. This will change over time because it’s based on actual production levels. In 2022, 2019-20 production will determine allowances.

Entities which emit more than the allowance must buy more, but only up to 20% above their free allocation. For gas-fired plants, their obligation is capped at the level of free allocation. In effect, this means power plants can emit significantly above limits and pay only for a portion.

The rules are not onerous, but this may be because the first phase is being used to explore the market and test the infrastructure. We expect the scheme to gain more teeth as the market expands, including a possible shift to a cap model. The EU’s ETS similarly began with a more generous model; giving free allocations to CO2 only. Over the past 15 years it has expanded to cover more greenhouse gases with a lower cap and fewer handouts.

4. There is built-in flexibility to evolve

China has more time to reach its goal of net zero; an additional decade beyond the EU’s target of 2050.

The real promise comes from the flexibility built into its scheme. Unlike when the EU’s ETS was introduced, China’s national ETS is engineered to allow changes in rates and coverage. We expect benchmarks to tighten over time, expand to cover other sectors (in particular steel, cement, and energy production) and possibly shift to more conventional economy-wide caps.

Europe’s experience has shown reductions in benchmarks and allocations can play an important role in reversing the upward trend of emissions in the long run.

5. Prices will need to rise

The price of carbon permits in the EU has sky-rocketed in recent years.

The scheme is set to cover more industries under the European Commission’s proposals to cut emissions by 55% on 1990 levels by 2030. Imports of steel, aluminium, cement, fertilisers, and electricity would face an equivalent impost from a carbon border tariff; a response to concerns EU polluters may relocate to avoid the EU scheme.

Hong Kong does not have its own carbon market, but polluting entities have two options for offsetting emissions: they can buy renewable energy certificates or buy credits in voluntary markets.

Renewable energy certificates are traded under the “Feed-in Tariff” Scheme, an initiative between the Hong Kong government and Hong Kong’s two power companies, CLP Power and Hong Kong Electric.

The scheme encourages renewable energy investments by allowing those who install solar photovoltaic (PV) or wind systems on their premises to generate renewable energy certificates and sell them - at a rate as high as about five times the normal electricity tariff rate - to the power companies. This delivers rapid returns and the revenue raised helps to cover the higher cost of electricity produced or bought from local green project owners. A third-party auditor verifies the quality and integrity of certificates annually, noted in the Renewable Energy Certificates Assurance Specification.

The power companies then sell these certificates, along with certificates generated from their own renewable-source electricity, to corporates and individuals. Priced at HK$0.50 per kilowatt-hour of energy – a premium to “normal” electricity rates – they give the purchaser the right to claim environmental attributes associated with the amount of electricity each certificate carries. Bulk purchases (5,100 units and up) are available on a first-come, first-served basis and open to price negotiation.

The increase in ESG policies and targets has contributed to a dramatic rise in the scheme’s popularity. CLP Power’s sales of renewable energy certificate grew by about 70% from 2019 to 2020 with some customers showing interest in “larger purchases of certificates, either for a greater amount or for a longer period, demonstrating their commitment to a greener, lower carbon Hong Kong”, its 2020 Annual Report notes.

Those seeking offsets can alternatively explore the voluntary carbon markets. Launched in April 2021, the Guangzhou Futures Exchange will develop carbon futures products and explore introducing electricity futures and climate-related products. Hong Kong Exchanges and Clearing Limited has a 7% stake and Chief Operating Officer Calvin Tai has hailed it as a means to extend “our promotion of green and low-carbon markets”, noting they were “already champions of sustainable finance within the Greater Bay Area”.

In China, the International Monetary Fund estimates that the price of carbon credits will need to reach around $50 per tonne to effectively drive down carbon emissions.

The World Bank cites the price needed to reach the 2 degree goal as between $US40-80 per tonne. Less than 4% of the world’s emissions are covered by carbon prices in that range based on World Bank data as at 1 April 2021, including in France ($US52) and Norway ($US69). Sweden had the highest rate at $US137.

To limit warming to the 1.5 degrees which the UN says may already be ‘locked’ in over the next decade, some suggest global carbon prices must reach a much higher point – up to $US160.

Yet in a sign of the accelerated net zero charge, the EU ETS price has doubled in the 6 months since April, reaching a record high of roughly $US100 in December 2021. The UK ETS, introduced on 1 January 2021 post-Brexit, is also rising. In November 2021 the average price was around $US80.

Some cover other greenhouse gases (carbon dioxide is one, albeit the main one when it comes to climate change; methane is another), akin to sulphur dioxide reductions leading to a focus on other aerosols like ammonia.

6. Links between ETSs will form – and markets will open

Emission trading schemes around the world are disparate and suffer from an absence of an overseeing agency to bring a level of standardisation, but links are forming.

Critical to the effectiveness of global efforts is the pursuit of a universal language in the carbon credit realm – a ‘common ground taxonomy’, enabling exchanges from Shanghai to New York to ‘speak’ to each other.

The possibility is more real following the UN Conference of the Parties in Glasgow in November 2021. The 197 nation parties agreed to resolve the difficult question over the development of global carbon market standards to replace the Clean Development Mechanism (CDM; dating back to Kyoto) as a base methodology.

The agreement follows years of efforts by independent bodies. The International Financial Reporting Standards Foundation – a US-based not for profit – develops sustainability standards through its two standard-setting boards: the International Accounting Standards Board (IASB) and the newly created International Sustainability Standards Board (ISSB).

Speaking of its efforts in 2020, IFRS Foundation Trustee Teresa Ko drew an analogy with global standards in financial reporting.

“In many uncanny respects, the state of sustainability reporting around the world mirrors the state of financial reporting before the IFRS Foundation was formed,” she told a virtual audience.

“We now have another opportunity to shape the way in which sustainability disclosure can be conducted on a global basis. We must seize that opportunity given the urgency and importance of climate-related risks and their effects on reporting entities.”

For China’s national ETS, trading in the GBA and possibly Hainan will be the first step.

Yet beyond this, we anticipate it won’t be long until companies are able to meet local emissions targets elsewhere by purchasing credits on the Shanghai Environment & Energy Exchange.

At a high level, there a hard questions: like whether carbon taxes are a more effective means to drive down emissions, and the role of carbon offsets in a reductions-focused world. Whatever the answer, China’s national ETS – along with others run by governments around the world – sits within a broader carbon pricing picture which includes the voluntary carbon markets run predominantly by NGOs. Together they will reflect and drive societal views and behaviours, from Hainan to Hawaiʻi.