This article was written by Minny Siu, Cindy Shek and Florence Lau.

On 28 August 2020, the Securities and Futures Commission (SFC) approved the authorisation of two exchange traded funds (ETF) to be listed on The Stock Exchange of Hong Kong Limited (HKEX) under a scheme which will facilitate cross-listing of ETFs between Hong Kong* and Mainland China (Scheme)[1]. On the same day, the China Securities Regulatory Commission (CSRC) also approved two ETFs to be listed on the Shenzhen Stock Exchange (SSE) under the Scheme.

The Scheme will allow Hong Kong investors to gain access to ETFs listed in Mainland China, and conversely, for Mainland investors to gain access to ETFs listed in Hong Kong. This is a much anticipated development to further connect the ETF markets between Hong Kong and Mainland China, following continued efforts by the SFC, the CSRC, the HKEX and the SSE to introduce an "ETF Connect" scheme to leverage on the success of Stock Connect[2] and Bond Connect[3].

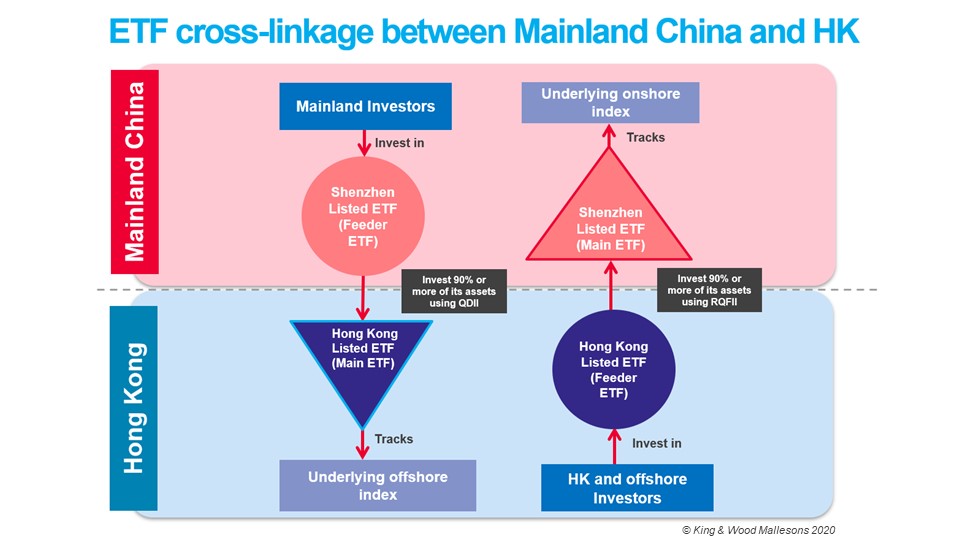

Connecting via a "Master-Feeder" Structure

Foreign investor access to investments in Mainland China:

- A Hong Kong ETF will be launched and listed on HKEX as the "feeder ETF"

- A RMB Qualified Foreign Institutional Investor (RQFII)[4] will act as the Hong Kong ETF's manager

- The Hong Kong ETF will be granted RQFII status through its manager to invest in the bundled Mainland ETF

- The Hong Kong ETF is required to invest at least 90% of its net assets in the bundled Mainland ETF listed on the SSE through the RQFII status

Mainland investor access to investments in Hong Kong:

- A Mainland ETF will be launched and listed on SSE as the "feeder ETF"

- A Qualified Domestic Institutional Investor (QDII) will act as the Mainland ETF's manager

- The Mainland ETF will be granted QDII status through its manager to invest in the bundled Hong Kong ETF

- The Mainland ETF is required to invest at least 90% of its net assets in the bundled Hong Kong ETF listed on the HKEX through the QDII status

The first two CSRC-approved Mainland ETFs under the Scheme would indirectly track the market performance of the Hang Seng China Enterprise Index and the S&P New China Industry (A-Share) Cap Index respectively.

The Scheme was foreshadowed by the SFC when it issued its circular[5] in December 2019 on streamlined requirements for eligible exchange traded funds adopting a master-feeder structure. The circular provides that an SFC-authorised feeder ETF may invest its assets in a master ETF listed in an overseas-listed ETF without its authorisation on a case-by-case basis, provided there are satisfactory safeguards and measures in place to address investor protection concerns and there are demonstrable benefits to the Hong Kong market, taking into account factors such as the size and significance of the master ETF, its track record and whether its underlying index is widely accepted.

Existing ETF Connectivity between Hong Kong SAR, Mainland China and other jurisdictions

ETF connectivity arrangements similar to the Scheme have been tested by Hong Kong and Mainland China.

The SFC has entered into similar arrangements more than ten years ago, and more recently, the China-Japan ETF Connectivity Scheme was launched in June 2019 between the Shanghai and Tokyo stock exchanges. Under the Sino-Japanese connect scheme, Mainland Chinese asset managers are allowed to set up Shanghai-traded ETFs through the QDII scheme that invest at least 90% of assets in Japanese ETFs that track either the Nikkei 225 Index or the Top Exchange. At the same time, there are also 4 ETFs that invest in A shares listed on the Tokyo Stock Exchange.

The Shanghai Stock Exchange has also been in talks with its counterparts worldwide about a possible bond connect programme with London, a stock connect scheme with Switzerland and a dual listing mechanism for stocks in India and Shanghai.

Stepping stone to a full "ETF Connect"

The Scheme is the first step to linking the ETF markets between Mainland China and Hong Kong. We look forward to seeing the complete development of an "ETF Connect" under which ETFs will be added to the list of eligible securities tradable under the Stock Connect.

In June 2017, HKEX Chief Executive Charles Li stated in an interview[6] that in light of the differences in settlement arrangements between stocks and listed funds, there are a number of system development and operational issues to iron out between the regulators. By using a feeder ETF structure, the Scheme avoids a number of the settlement and other operational issues which would arise under a dual-listing arrangement.

The industry is enthusiastic about the launch of the Scheme, noting that by linking the two ETF markets, PRC and international investors alike would be able to diversify their investment portfolios and gain access to different asset classes. In particular, international investors could use it to gain direct access to PRC onshore ETFs, which offer exposure to a broader range of onshore equities.

Conclusion

The Scheme is an important step to boost the ETF market in Hong Kong, and aligns with the broader developments which we are seeing in the Greater Bay Area (see our latest publication on the new development plans for the Greater Bay Area) and the wealth management connect between Hong Kong and Mainland China.

There is market expectation[7] that the government will, in the coming year, reinforce the cross-border wealth management system and push for the inclusion of ETF into Shenzhen-Hong Kong Stock Connect as another Greater Bay Area initiative to connect the financial markets of Hong Kong and Shenzhen.

We look forward to working with you in expanding your business.

*Any reference to "Hong Kong" or "Hong Kong SAR" shall be construed as a reference to "Hong Kong Special Administrative Region of the People's Republic of China".

[1] SFC, "Hong Kong-Mainland ETF cross-listing approved" (28 August 2020), available at https://www.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=20PR80

[2] Launched in November 2014, Stock Connect is a joint initiative of the China Securities Regulatory Commission and Hong Kong's Securities and Futures Commission. It allows mutual stock market access between the Shanghai Stock Exchange or the Shenzhen Stock Exchange and The Stock Exchange of Hong Kong Limited.

[3] Bond Connect is a mutual access scheme for offshore investors to access the Mainland China bond market and for onshore investors to access the Hong Kong bond market through a market infrastructure linkage between Mainland China and Hong Kong.

[4] For more details, please refer to our publication entitled "Latest relaxations in the qualified foreign institutional investor and renminbi qualified foreign institutional investor regimes" (May 2020), available at https://www.kwm.com/en/hk/knowledge/insights/latest-relaxations-in-qfii-and-rqfii-regimes-20200515.

[5] SFC, "Circular on streamlined requirements for eligible exchange traded funds adopting a master-feeder structure" (dated 16 December 2019), available at https://www.sfc.hk/edistributionWeb/gateway/EN/circular/doc?refNo=19EC73

[6] HKEX, "Chief Executive Charles Li's Elaboration on HKEX's Key Initiatives in 2017 Presented at the Annual Media Luncheon" (dated 19 January 2017), available at https://www.hkex.com.hk/-/media/hkex-market/news/news-release/2017/170119news/1701193news (Question 2)

[7] Asia Times Financial, "Hong Kong to be a hub for China's wealth market" (dated 19 July 2020), available at https://www.asiatimesfinancial.com/hong-kong-to-become-a-major-hub-for-china-s-wealth-management-market