Authors: Ashley Wong and Adam Smart

The authors would like to thank Ma Feng, Yan Qiong, Alison Chan and Sunny Wong for their assistance on this article.

The outbreak of COVID-19 has had a significant impact on the global aviation industry. Airlines globally have been forced to reduce their flight operations and the International Air Transport Association ("IATA") predicts a 48%[1] drop in air travel globally in 2020 (year on year). Until countries around the world remove their current quarantine and travel restrictions, the overall impact of COVID-19 on the aviation industry remains unknown. Nevertheless, aviation is a resilient industry and has previously managed to overcome the challenges posed by 9/11, SARS and the 2008/9 financial crisis and thrive.

Whilst it is difficult to predict how quickly the aviation industry as a whole will re-emerge from this crisis, the aviation industry in the Guangdong-Hong Kong-Macao Greater Bay Area (the "GBA") may be a step ahead having the benefit of a recovering domestic market in the Mainland. In addition, new measures have been announced by the People's Bank of China, together with the Mainland's banking, securities and foreign exchange regulators in April 2020 (the "2020 Guidance"), which provide the potential for the aviation industry to adapt to the new economic/global environment and to explore new opportunities in the GBA. This article recaps the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area released on 18 February 2019 (the "Outline"), highlights certain developments in the GBA since the publication of the Outline and identifies new opportunities from the 2020 Guidance, each with a focus on the aviation sector.

A brief overview of the GBA and the Outline in the context of aviation[2]

The GBA consists of Hong Kong SAR*, Macao SAR, as well as the municipalities of Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing in the Guangdong Province, with a combined population of approximately 71.16 million at the end of 2018.[3] As one of the most open and economically vibrant regions in China[4] with an aggregated GDP of US$1,641.97 billion and a GDP per capita of US$23,075 in 2018, the GBA plays a significant strategic role in the overall development of China.

The Outline was jointly prepared by the relevant departments of the central government of China together with the governments of the Guangdong Province, Hong Kong SAR and Macao SAR. The Outline set out an economic development plan for the GBA, including a vision of developing an international innovation and technology hub, expediting infrastructural connectivity, promoting ecological conservation, and jointly developing Guangdong-Hong Kong-Macao cooperation platforms. As part of these development objectives, the Outline sets out a vision for developing an international aviation hub in the GBA.

The Outline also sets out a goal for each of the key GBA cities, several of which are focussed on the development of the aviation industry in the GBA: Hong Kong SAR should position itself as an international financial centre, an international aviation hub and an international legal and dispute resolution hub in the Asia-Pacific region; Shenzhen should position itself as a national core economic city and innovation hub; whilst Guangzhou should position itself as an integrated transportation hub.

The aviation sector in the GBA

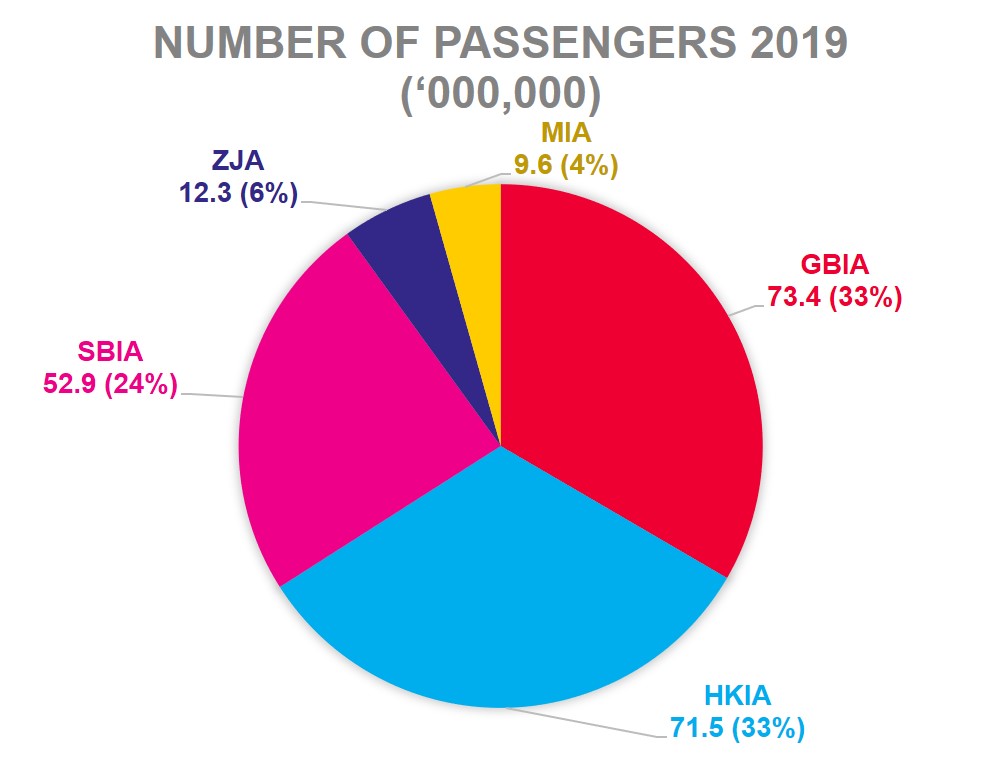

Even before expansion pursuant to the Outline, the GBA was already a significant aviation hub both in China and the wider Asia-Pacific region. There are ten civil airports in the GBA, with Hong Kong International Airport ("HKIA"), Macau International Airport ("MIA"), Shenzhen Bao'an International Airport ("SBIA"), Guangzhou Baiyun International Airport ("GBIA") and Zhuhai Jinwan Airport ("ZJA") being the most significant airports in the region (the "GBA A5").

(i) Comparison of the GBA A5[5]

HKIA, GBIA and SBIA are the most significant airports amongst the GBA A5, with notably higher annual traffic (in terms of both passenger traffic and cargo throughput). HKIA, GBIA and SBIA are therefore key focus airports for development by the regions of the GBA. As can be seen from the figures below (and the number of international routes noted above), SBIA is currently relatively underdeveloped compared to its neighbours. In light of the Outline's specific requirements for developing SBIA (such as enhancing its competitiveness as an international hub and building a demonstration zone for Shenzhen's general aviation industry), SBIA has significant room for potential growth in the near future.

|

|

- Source: 2019 Statistics of Civil Aviation Administration of China

- © King & Wood Mallesons 2020

(ii) Significance of the GBA A5 in China[6]

HKIA, GBIA and SBIA also play a key role in the overall Chinese aviation sector, both in relation to passenger and cargo traffic. HKIA, GBIA and SBIA account for approximately 33% of the number of passengers handled by the top 10 airports in China, whilst HKIA, GBIA and SBIA account for approximately 51% of the cargo handled by the top 10 airports in China. With the resurgence of the Mainland domestic market following the COVID-19 crisis, it can be expected that airports in the GBA (in particular GBIA and SBIA) will recover faster than competitor airports in the Asia-Pacific region.

(iii) Planned developments of the GBA A5[7]

In addition to the recently completed expansion of passenger terminals at both SBIA and GBIA, each of the GBA A5 are taking significant steps to expand their physical infrastructure over the coming years, as encouraged in the Outline.

| Airport | Plan |

| HKIA | Increase the number of runways from 2 to 3 |

| MIA | Construct a south extension of the passenger terminal building |

| SBIA | Increase the number of runways from 2 to 3 |

| GBIA | Increase the number of runways from 3 to 5 and construct a third passenger terminal building |

| ZJA | Construct a second passenger terminal building |

These planned infrastructure developments will necessitate the growth of related industries in the GBA, including ground services, logistics, air traffic control, aircraft maintenance and crew training facilities.[8] In addition, technology companies may also have a role to play as airports in the GBA, in particular HKIA, aim to become smart airports.[9] The COVID-19 crisis is likely to mean that the development of technological advances in airports occurs faster than it may otherwise have done, given the need to minimise interaction amongst passengers and between passengers and staff.

Developments since the publication of the Outline

(i) Expansion of the intermodal code-sharing services between the Mainland and Hong Kong SAR[10]

As highlighted above, one of the Outline's focuses is on building a modern comprehensive transportation system in the GBA, including developing a world-class airport cluster. Chapter 5 of the Outline also aims to ensure the smooth linkage of different modes of transportation within the GBA and raise the standards of passenger and cargo transportation services, with the goal of reducing the travel time between any two major cities in the GBA to one hour or less. Effort has already been made by cities in the GBA to implement this aspect of the Outline. One example is the expansion of "intermodal code-sharing" between transportation companies in the Mainland, Macao SAR and Hong Kong SAR.

The intermodal code-sharing scheme allows a passenger travelling by air to take another mode of transport (e.g. cross-boundary buses or high-speed ferries) using the same air ticket, which helps to make travel planning more convenient and efficient for travellers and encourages the use of multiple forms of public transportation by passengers in the GBA.

Prior to the introduction of the Outline, designated airlines were only permitted to operate air-to-land intermodal services in conjunction with cross-boundary buses running between Hong Kong SAR and Shenzhen. However, following the issuance of the Outline, designated airlines are now allowed to enter into code-sharing arrangements with operators of all kinds of land transportation (including railway services, passenger vehicles and coaches) to all cities in the Mainland. In addition, airlines are permitted to enter into air-to-sea intermodal code-sharing arrangements. The Mainland and Hong Kong SAR now have increased sea transportation options between HKIA and cities in the GBA, including Macao SAR, Fuyong, Humen, Jiuzhou, Lianhuashan, Nansha, Shekou and Zhongshan. This includes airport check-in facilities at Shenzhen Shekou Cruise & Ferry Terminal, Zhuhai Jiuzhou Port and Guangzhou Lianhuashan Port, allowing passengers to go directly to the departure hall upon arrival at HKIA.

Separately, measures have been introduced to streamline boundary crossing rules within the GBA. Check-in facilities for HKIA have also been introduced at the Hong Kong Port of the Hong Kong-Zuhai- Macao Bridge and at West Kowloon Station. Cross-boundary helicopter services are now also permitted between Hong Kong and the rest of the GBA.

The expansion of the intermodal code-sharing services allows airlines operating from HKIA to offer seamless air-to-land and air-to-sea connections with other destinations in the GBA, further enhancing Hong Kong SAR's position as an international aviation hub within the GBA. This offers significant growth potential for airlines in Hong Kong SAR, given that GBA passengers (excluding Hong Kong SAR passengers) accounted for less than 10% of one major Hong Kong SAR based airline's passenger numbers in 2019. A more comprehensive transportation system in the GBA will naturally also provide increased opportunities for other aviation/transportation related businesses to grow, both at HKIA and also at the other airports in the GBA (in particular GBIA and SBIA). This might even include a helicopter ride-hailing service and electric pilotless aircraft in the GBA if Airbus' plans come to fruition.[11]

(ii) Introduction of the 144-Hour Transit Visa Exemption Policy[12]

In order to encourage tourism in the GBA and the development of GBIA and SBIA as international aviation hubs, from May 2019 foreign visitors from 53 countries can visit Shenzhen, Guangzhou or any other city in Guangdong without the need for a visa for 144 hours (this includes visitors from countries in the European Union, the United Kingdom, Australia and the United States).

In order to do so, visitors need to hold a valid international travel document and a connecting ticket to a third country or region. Hong Kong SAR and Macao SAR are considered as a third regions from the Mainland under this policy. Visitors need to enter the GBA via GBIA, Jieyang Chaoshan Airport or SBIA. This policy makes transiting at GBA airports more convenient and gives visitors the ability to explore the GBA without the need for a visa.

From the perspective of airlines based at GBIA and SBIA, including China Southern Airlines and Shenzhen Airlines, this policy offers the opportunity to increase their share of valuable international transfer customers transiting at GBIA and SBIA. Currently this market is underdeveloped by airlines and airports in the GBA, other than by Cathay Pacific at HKIA, given most international traffic is either currently point-to-point in nature or limited to international-to-domestic transfers within the Mainland. The physical expansion of both at GBIA and SBIA should provide the capacity needed for the growth of transit passengers to take place.

(iii) Aircraft leasing in the Nansha Free Trade Zone and Hong Kong SAR[13]

Another key focus of the Outline is to develop the China Guangdong Free Trade Zone (the "GFTZ"). The Nansha Free Trade Zone (the "Nansha FTZ") in Guangzhou is one of the three areas of the GFTZ. The Outline aims to develop financial services within the Nansha FTZ, including fintech, aviation finance and aviation leasing. The Outline also advocates close cooperation between Hong Kong SAR and Nansha FTZ, in order for Nansha FTZ to become a gateway to the Mainland.

Market participants have begun structuring their transactions with Mainland airlines (as lessees) via both Hong Kong SAR (at the owner level) and Nansha FTZ (at the lessor level), with a similar lease-in and lease out structure in other free trade zones in the PRC. By transacting through the Hong Kong SAR plus Nansha FTZ cross-border leasing structure, aviation leasing companies can enjoy the advantages of access to the international financial markets in Hong Kong SAR and the dedicated concessionary tax regime for qualifying aircraft lessors. The dedicated tax regime in Hong Kong SAR provides a concessionary tax rate of 8.25%, which is 50% of the current profits tax rate of 16.5%, for both qualifying aircraft lessors and qualifying aircraft leasing managers. Only 20% of the tax base (gross rentals minus deductible expenses (but excluding depreciation)) of qualifying aircraft lessors will be subject to profits tax, resulting in a net tax rate of 1.65% (that is, 20% x 8.25%). Furthermore, the double taxation agreement between the Mainland and Hong Kong SAR offers a lower withholding tax rate of 5%, making Hong Kong SAR the jurisdiction with the lowest withholding tax applied on lease rentals paid by Mainland lessees, followed by Singapore and Ireland with a rate of 6% withholding tax.[14]

The Nansha FTZ company can also benefit from preferential import duty and customs clearance policies in the Nansha FTZ. To date more than 120 commercial aircraft have been bought into the Nansha FTZ (within the past five years), including aircraft operated by China Southern Airlines.[15] In terms of leasing companies set up in the Nansha FTZ, the number of financial leasing companies in the Nansha FTZ has increased from about 30 at the beginning of 2015 to more than 2,100 in 2019, including Skyco International Financial Leasing Company and China Southern International Leasing. Many of the state-owned enterprises have also set up financial leasing operations in the Nansha FTZ.[16]

As part of the development of the GBA as an aviation hub, it is expected that Nansha FTZ/Hong Kong SAR will further develop as a key leasing structure into the Mainland for aviation transactions, in particular for airlines based in the GBA.

(iv) 2020 guidance on financial support for the GBA[17]

In April 2020, the People's Bank of China, together with the Mainland's banking, securities and foreign exchange regulators announced several new measures to encourage the growth of the GBA in the 2020 Guidance. One of the key principles included in the 2020 Guidance is to encourage financial co-operation between the Mainland, Hong Kong SAR and Macau SAR and to enhance the position of Hong Kong SAR as an international financial centre.[18]

In addition, the 2020 Guidance encourages the growth of cross-border lending in the GBA, both from Mainland banks to entities in Hong Kong SAR and Macau SAR and from branches of Hong Kong SAR and Macau SAR banks in the Mainland to entities in the GBA. The 2020 Guidance also suggests increased support for other non-banking cross-border businesses, including financial leasing companies.

The 2020 Guidance, once implemented, will further enhance financial co-operation within the GBA. From an aviation leasing perspective, the advantages of the Nansha FTZ/Hong Kong SAR leasing structure may become even greater if lending costs are reduced or if further financial or tax incentives are offered by authorities in the GBA.

(v) Development of related industries in the GBA

It is reported that China's maintenance, repair, and overhaul ("MRO") market stood at RMB 128.68 billion in 2018, generating a compound annual growth rate of 9.32% between 2010 and 2018.[19] With the development of aviation industry in the GBA, in particular, with increasing demand for aircraft in the GBA in order to support increased air traffic, there is a significant market for aircraft MRO businesses.

One example of this is Guangzhou Aircraft Maintenance Engineering Co., Ltd. ("GAMECO"), jointly owned by China Southern, Hong Kong Hutchison Whampoa (China) Co and South China International Aircraft Engineering (HK) Company Limited, which is investing and building a third hangar, a component repair centre and a composite centre in the GBA. The building of the third hangar is expected to be finished in 2021, and it is located near GBIA and can accommodate six wide-body aircraft and five narrow-body aircraft for heavy maintenance at the same time. GAMECO's new component repair centre and the composite centre, which are located in Guangzhou, are expected to come into service in 2022.

It is anticipated that additional MRO operators will open, or existing MRO operators will expand, within the GBA in the foreseeable future. Given one of the aims of the Outline is to develop the GBA as a centre for technology and innovation, this expansion may also involve the increased use of augmented and virtual reality technologies, both in relation to training and possibly remote maintenance and inspection of aircraft.[20] Both MROs and technology companies may therefore have a role to play in the expansion of this area.

Besides MRO services, the GBA can also develop other aviation-industry related services, including ground handling service, airport infrastructure, pilot training, airport management training and aviation business management training etc with a view to creating an integrated development of the aviation industry supply chain.

KWM in the GBA

Having been established in the GBA for over a decade, KWM is well-placed to help our clients navigate the intricacies and complexities of the area, while helping them realise their objectives.

In April 2018, KWM announced the creation of the KWM International Centre in the GBA to combine the expertise of our Hong Kong SAR, Shenzhen, Guangzhou, Sanya and Haikou offices, as well as the resources of our global network.

Our offices in the GBA boast over 550 legal professionals, who are well positioned to provide one-stop comprehensive legal services for our clients in Hong Kong SAR, the Mainland and abroad.

[1] Reference: https://www.iata.org/en/pressroom/pr/2020-04-14-01/

[2] Reference: https://www.kwm.com/en/hk/knowledge/downloads/law-and-practice-in-the-greater-bay-area-ii-20190920

[3] Reference: https://research.hktdc.com/en/article/MzYzMDE5NzQ5

[4] Reference: https://research.hktdc.com/en/article/MzYzMDE5NzQ5

[5] Reference: http://www.caac.gov.cn/XXGK/XXGK/TJSJ/202003/t20200309_201358.html; https://www.aacm.gov.mo/news_traffic.php?pageid=86&lg=eng; https://www.hongkongairport.com/en/the-airport/hkia-at-a-glance/fact-figures.page

[6] Reference: http://www.caac.gov.cn/XXGK/XXGK/TJSJ/202003/t20200309_201358.html

[7] Reference: HKIA - https://www.threerunwaysystem.com/en/overview/project-overview/; MIA - https://www.macau-airport.com/en/media-centre/news/news/23932; SBIA -http://www.szairport.com/szairport/gsxw/202003/2478408b80c94af0bd51b88f43fd63ef.shtml; GBIA - https://www.gbiac.net/byairport-web/menu/index?urlKey=airport-basic-facts_en; ZJA - http://www.caacnews.com.cn/1/5/201911/t20191129_1286621.html

[8] Reference: https://www.info.gov.hk/gia/general/201907/30/P2019073000632.htm

[9] Reference: https://www.thb.gov.hk/eng/blog/index_id_10.htm

[10] Reference: https://www.info.gov.hk/gia/general/201802/01/P2018020100693.htm?fontSize=1 and https://www.info.gov.hk/gia/general/201902/19/P2019021900578.htm?fontSize=1

[11] Reference: https://asiatimes.com/2019/09/airbus-eyes-hail-a-copter-service-for-greater-bay/

[12] Reference: http://gdga.gd.gov.cn/xxgk/zcjd/wjjd/content/post_2286867.html and https://www.chinadiscovery.com/shenzhen-tours/shenzhen-144-hour-twov.html

[13] Reference: http://nansha.guangdong.chinadaily.com.cn/2019-07/05/c_386186.htm and http://www.chinadaily.com.cn/a/201904/01/WS5ca1d166a3104842260b3bd6.html

[14] Reference: https://www.ird.gov.hk/eng/tax/bus_ala.htm; http://www.hkala.com.hk/docs/Event%20Presentations%20-%20Taxation%20workshop.pdf (see slide 7); and https://www.kwm.com/en/cn/knowledge/insights/hk-s-proposed-dedicated-tax-regime-for-offshore-aircraft-leasing-20170306

[15] Reference: http://subsites.chinadaily.com.cn/guangzhou/nansha/2019-08/23/c_398934.htm

[16] Reference: http://nansha.guangdong.chinadaily.com.cn/2019-01/02/c_312574.htm

[17] Reference: http://www.cnbayarea.org.cn/policy/policy%20release/policies/content/post_258474.html

[18] Reference: https://kwm.com/en/hk/knowledge/downloads/new-plans-to-support-gba-unveiled-20200608

[19] Reference: http://global.chinadaily.com.cn/a/201906/17/WS5d06f2eba3103dbf143288e6.html

[20] Reference: https://www.sciencedirect.com/science/article/pii/S2351978918300222

*Any reference to "Hong Kong" or "Hong Kong SAR" shall be construed as a reference to "Hong Kong Special Administrative Region of the People's Republic of China".